🏴☠️ ⚡️ Achievements & Learning Lessons from Year One (Portfolio Performance & Strategy)

This newsletter is dedicated to Acquiring and Operating Micro SaaS firms. Join us every Saturday morning for acquisition case studies, operational tactics, growth frameworks, and more!

TABLE OF CONTENTS:

// Q124

REFLECTION & DIAGNOSIS

MAIN ACHIEVEMENTS

KEY LEARNING

BY THE NUMBERS

MRR, ACTIVE USERS & REVENUE

CORE PERFORMANCE METRICS

OKR EXECUTION

STRATEGIC PLANNING

Q224 OBJECTIVES

// YEAR ONE (Y1) FINISH

REFLECTION & DIAGNOSIS

MAIN ACHIEVEMENTS

KEY LEARNING

Y1 GOAL EXECUTION

STRATEGIC PLANNING

Y2 GOALS

📺 WATCH:

📻 LISTEN:

Q124

// REFLECTION & DIAGNOSIS

🎖️ MAIN ACHIEVEMENTS

Stable at ~$20k MRR: With much greater quality revenue (standardized across 3x plans and monthly or annual billing cycles) with positive momentum across MRR, Revenue, and User growth

The first substantive product release has been very well received: We’ve modernized outdated pages that impact our users' clients—the number one user complaint. This release also establishes a predictable engineering velocity while derisking the business as a whole by reducing technical debt.

1x fully scalable acquisition channel locked and loaded (cold outbound): We have 140k deeply enriched leads at our disposal, with automation and generative AI at the core of the operating model.

Early signs of ROI on our content and audience effort: Site traffic and trial signups show structural improvement on very little effort as a function of turnkey operating system for generating, repurposing and distributing content to grow and build trust with a relevant audience.

🤔 KEY LEARNING

Always start with cold outbound: We chose to solve for trial-to-paid conversations out of the gate (via onboarding experience), given we were well below benchmark performance (~3% vs 20%). We new product was the root issue and we had loose conviction around the most important jobs-to-be-done across customer segments. The result was wasted time and capital. Instead, we could have started with cold outbound as the first growth tactic, given it is by far the cheapest on a relative basis and allows us to harvest useful data (i.e., the most important pain points / business outcomes for users) to improve and segment onboarding later. There is an opportunity cost involved; however, where you burn through a portion of the market by sending them into an onboarding where few convert, but driving the top of the funnel via cold outbound is a much more strategic starting point.

Room to be more data-driven: Our product roadmap exercise did not include a designated step for factoring current usage. We reviewed and discussed but not enough rigor here. Furthermore, we missed on prioritizing geographic location as a priority feature when determining the first segment for cold outbound.

Our objectives still contain too many KRs: We need to fixate on results and leave tons of room around inputs/process, as we ‘learn about the work by doing the work.’ I was too maniacal about documentation early to ensure repeatability. Let elite humans run and dial in playbook after, duh.

Product release calendars need more slack: We need to, again, provide more slack between our internal release timelines and the release dates / expectations we socialize with user. We’re moving from 2 to 4 weeks, as this release still felt a bit rushed, and that can lead to unforced errors (though we managed to avoid any).

Tech debt = drag on engineering speed and release predictability: Furthermore, we need to establish a spectrum of tech debt such that we can place future acquisitions on a relative basis. Tech debt has held back and consumed resources from growth initiatives. Moving forward, we will only pursue deals with relatively less tech debt. Nonetheless, the experience has been invaluable and strong validation of our engineering capabilities.

🔢 BY THE NUMBERS

MRR, ACTIVE CUSTOMERS & REVENUE

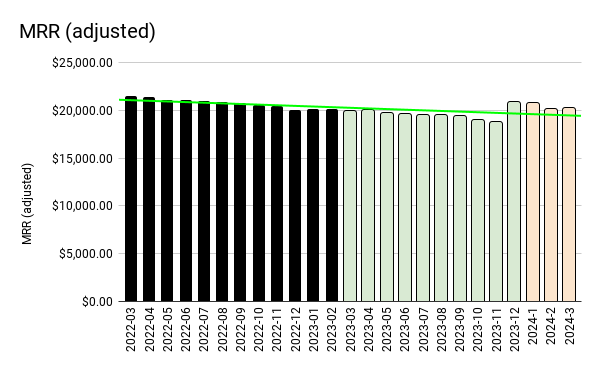

Disclaimer: As noted previously, a small fraction of subscriptions have yet to be billed via Stripe, so we’ve included manual charts as well to reflect business performance more accurately. Our ownership is signaled via green bars in the charts, with Q124 highlighted in orange.

Comments & Observations:

MRR: The pricing refresh in Q424 was a useful forcing function for standardizing pricing plans and moving all plans to one overarching system of record for billing (Stripe). That said, we also released annual plans, which inflated MoM MRR numbers and growth. After Q124, we can confidently say the business has normalized at ~$20k MRR with MUCH better quality revenue. On a trailing 24 months (T24M) basis, the trend line is in subtle decline, though looking at Q124 (the orange-colored bars) we see solid positive momentum. Nonetheless, and as you’ll note in the Y1 analysis section at the bottom of this post, we are behind the ball on organic user acquisition, though the growth engine is well primed heading into this quarter, and we plan to make up lost ground (vs adjusting Y2 targets down).

Revenue: We’re feeling really good here, relative to our goals, though, as mentioned above, we must now rely on organic user growth to drive revenue. Cold outbound is our answer here. Look for net new MRR to drive revenue growth in 2024.

ARR per FTE (3): Our entire thesis is underpinned by operating leverage, which is a function of fractional contributors that create outsized impact. Today, at the tail end of the ‘transformation state,’ we’re punching at ~$74k per FTE, which is on par with private SaaS firms generating ($1-5M ARR, or 5x our ARR…). In Q324, we’ll transition to steady state and will then punch like a firm doing more than $50M ARR. This is what our strategy is about.

CORE PERFORMANCE METRICS

Comments & Observations:

Please note: Seasonality is a factor for our customer profile, where Q4 generally creates the most buying behavior. Thus, the spike in new visitor sessions in Nov, followed by trial-sign ups spike in Jan, onto the churn spike in Fev and our new paying user spike in March. The below commentary is based on the seasonality assumption.

New Visitor Sessions: If we adjust for seasonality, we are seeing a solid structural 3% MoM improvement to new visitor sessions, which we can to attribute to our content and audience efforts, measured via organic search (visitors by source) and google / search engine (signups by source). SEO results compound over time so we should see this accelerate this quarter.

Trail Signups: We are seeing a 10% MoM improvement here, which we attribute to content and audience-building techniques, under the assumption we are driving better QUALITY traffic. This should pop off once cold outbound is in full swing.

Trial to Paid Conversion Rate: Our trailing twelve month (TTM) average of 4.09% is miserable, though we’re very encouraged by the 17% conversion rate over the last 30 days. Cold outbound driving better quality traffic + revamped onboarding to better convert that traffic = our recipe for growth in 2024.

Churn: As has been the case, churn is the crown jewel for this business, and we’ve actually been able to improve this metric (1.5% » .83%) via support model optimizations, systems-based ticket management, and a revamped knowledge center.

🛠️ OKR EXECUTION

OBJECTIVE #1 — 50% increase in blog content and social post volume to uncover impact to new site visitors (how correlated is content / social volume to site visitors?)

KEY RESULTS:

Create a backlog of SEO-optimized blog titles based on Ahrefs keyword research and inference LLM model recommendations re trends in our target market

Create 50x long-form posts via byword using the titles created above

Establish an independent brand for the blog

Establish newsletter mechanism and subscriber sign-up / onboarding to capture lead and segmentation data

Increase social post volume to 5x / week

Analyze results to uncover correlation between content volume and new visitor traffic

EXECUTION SCORE: ⭐️⭐️⭐️⭐️

REFLECTION / DIAGNOSIS:

We executed all Key Results (there were WAY too many!) in the designated timeline

Too early to be confident in business impact, as site visitors is a lagging indicator, though we’re very optimistic per early results

Valuable content and audience operating system (OS) established and always on, incredible source of operating leverage (repeatable and scalable)

MOVING FORWARD:

Need to move toward more consistent long-form content creation (weekly drip vs monthly burst)

OBJECTIVE #2 — Implement a segment-based and product-native onboarding experience to set the foundation for improved trial-to-paid conversions (T30 Base Rate: 7.41%)

KEY RESULTS:

Create an Onboarding Experience Flowchart: Work with Customer Success and Design to develop an onboarding experience flowchart, which conveys the minimal onboarding steps and action items / exit criteria for each step by January 19th.

Build Onboarding Wireframes: Complete initial onboarding wireframes with the design team, ensuring the substance of each onboarding step is generally mapped to the user experience and functionality requirements by February 2nd

Execute engineering, Iterative QA, and Testing: Work with engineering to implement each step of the new onboarding experience (as available) in the testing environment, with the first onboarding step ready for QA by February 9th.

Release the new onboarding experience, targeting a completion rate of +75% (respective to the segment’s most important outcome), by March 8th

Execute trial user survey and identify patterns to improve

EXECUTION SCORE: ⭐️⭐️☆☆

REFLECTION / DIAGNOSIS:

This work was not sufficiently shaped to include in a time-bound OKR; instead, we should have OKR’d shaping the work (with a more thorough engineering estimate) to then proceed based on appetite

Validation of atomic operating unit and cross-functional collaboration, though we grossly underestimated engineering intensity

MOVING FORWARD:

No product or onboarding initiative can be included as an OKR if the work isn’t fully shaped (aka user flow, UX, engineering estimate)

OBJECTIVE #3 — Maintain product release momentum to keep the product relevant and maintain user retention >98.5%

KEY RESULTS:

Release brand settings by March 31st

Follow the product release playbook for all

Maintain 80% approval for all

EXECUTION SCORE: ⭐️⭐️⭐️☆

REFLECTION / DIAGNOSIS:

Very solid user satisfaction and engagement, ~10% increase in adoption across core features with no major user blowback or release issues

We missed a bit on scheduling respective release items per a phased release strategy, as a function of disconnect between engineering backlog and best case release schedule

MOVING FORWARD:

Need to further increase slack re external user expectations around release timelines (2 week > 4 week delta between internal and external)

Dedicated meeting across internal and external engineering at the start / end of a product sprint

OBJECTIVE #4 — Establish and warm up cold outbound capabilities

KEY RESULTS:

Manually craft outbound campaign to existing users (assuming they are prospects)

Analyze the last 10x paid users (firmographics, segment, and product usage) and identify 3x attributes to inform segment prioritization

Finalize personalization inputs / substance and optimal channels

Determine first priority target segment and create multi-touch campaign template

Finalize lead sourcing and enrichment method / tooling

Execute limited campaign (~300 leads over 4 weeks) to start warming up domains

Execute full campaign (1k+) and establish base rate trial sign-up conversions (beat 3.5%!)

Establish v1 Playbook: Cold Outbound

EXECUTION SCORE: ⭐️⭐️⭐️☆

REFLECTION / DIAGNOSIS:

Too many KR’s!

We oscillated around systems and automation instead of getting cold outbound out the door and gathering data. Needed more scientific process (experiment framing) in the objective itself. Furthermore, we could have been more iterative in our approach (e.g. start truly manual and warm up > look at data > iterate)

MOVING FORWARD:

Hit this as hard as humanly possible!

// STRATEGIC PLANNING

🎯 Q224 OKRs

OBJECTIVE #1: Acquire 10x paid users via cold outbound

OBJECTIVE #2: Release the modernized onboarding experience and achieve a trial user completion rate of 75%+

OBJECTIVE #3: Release chat bot beta (gen AI) to further reduce operational burden

YEAR ONE (Y1) FINISH

// REFLECTION & DIAGNOSIS

🎖️ MAIN ACHIEVEMENTS

Executed all transformation activities, established repeatable playbooks / operating systems and scalable transformation team

Brand & Website Refresh

Consolidated tech stack (across all operations and customer touch points) with real-time performance analytics

Ambassador OS, Content & Audience OS, Cold Outbound OS

Strategic Investment Decision-Making Framework

Achieved world-class retention (99.12%) via support function optimization and product release execution

Improved Average Revenue Per User (ARPU) to $40.24 (+12%) and generated significant free cash flow (~$20k) via new pricing and monetization

Grew Customer Lifetime Value (LTV) to $1,805 (+39.6%) as a function of Retention and ARPU

Positive QoQ trend lines across all performance metrics:

New site visitors, trial signs ups, and new paying users

Support ticket volume, response, and resolution time

Achieved predictable engineering velocity with 80% user approval for all releases; radically reduced the risk profile of the business by successfully overcoming tech debt (HUGE win)

Established 2x ‘always on’ acquisition channels: Ambassador Program, Content & Audience OS (blog, newsletter, cross-social platform distribution)

🤔 KEY LEARNING

Net new MRR goals start when the transformation period ends (~end of Q2Y1 in holding period)

Priority #1 is training an inference model (aka a GPT) on all existing support and product documentation to radically accelerate ramping your team on domain and tribal knowledge

Despite plans to modernize the operational tech stack, immediately establish centralized, real-time visibility across the business and customer touchpoints via a simple dashboard slack alerts

Always start with the cheapest growth tactic available; worst case, you’ll harvest super useful data

Assume pricing and monetization is a powerful lever (Micro SaaS Founders / Sellers generally lack commercial expertise)

Content creation and distribution is one of the largest points of operating leverage available today

Heavily incentivize and enable your biggest fans out of the gate, as they’re already working hard for you

Onboarding = sales process (in SMB B2B SaaS)

Onboarding is a product-based activity, in-app guides are just bandaids

Tech debt must be understood on a relative spectrum measured via drag on your growth thesis or go-to playbooks

🏁 Y1 GOAL EXECUTION

Comments & Observations:

We were generally optimistic with our Y1 goals, anchoring around benchmarks for venture-backed firms in relation to MRR and revenue growth for SaaS Comparable based on MRR cohort (20% YoY Growth by Y3). The Pricing and Monetization refresh made a huge contribution to Subscription Revenue goals, though we fell short on organic new user growth as measured by new MRR. These goals were also in the context of a ‘transformation period’ and assembling a repeatable bench of functional contributors across key functions. Furthermore, the playbooks we’ve honed over the years needed to be adapted to the Micro SaaS context. We weren’t just establishing a foundation for growth at our port co; we are establishing a repeatable engine for Skaling Ventures as a firm. All to say, we’re generally pleased with where we landed in Y1 (at 95% of Revenue targets), though we fell well short of our organic growth goals and have our work cut out for us in Y2.

We have a clear line of sight toward achieving our Y2 goals and pivoting to ‘steady state’ in Q324 and beyond. In addition, we plan on adding acquisition #2 to the mix this year, where I’m confident we’ll witness a 20%+ rate of improvement across every dimension after inventing (and refining) the wheel with our first port co…