🏴☠️ ⚡️ Build Better ARR: Why Smart Operators No Longer Chase the Topline

Join us every Saturday morning for value creation playbooks, operating concepts, deal analysis and diligence frameworks, and more...

TABLE OF CONTENTS:

Why ARR is Under Pressure

First Principles: What Makes ARR Valuable?

The ARR Flavor Spectrum

Treat ARR Like an Asset Class

How to Flavor Grade Your Business

Metrics That Matter & Scorecards to Reinforce Quality

The Real Win—Upgrading Your Revenue Mix

📺 WATCH:

📻 LISTEN:

ARR isn’t dead—but our understanding of it should be.

In a market no longer rewarding growth-at-all-costs, operators, investors, and acquirers are waking up to the same truth:

Not all ARR is created equal.

We need to stop treating ARR like a monolithic number and start treating it like a portfolio. Each dollar of ARR carries its own risk profile, margin structure, and retention trajectory. Once you accept that, the strategy shifts.

This post is a blueprint for the modern operator who doesn’t just want more revenue—they want better revenue.

Why ARR Is Under Pressure

Before we talk about what makes ARR valuable, we have to acknowledge something more fundamental:

ARR is no longer universally understood—or universally relevant.

There’s a growing discrepancy in what ARR actually means. Operators and finance leaders increasingly debate:

Is ARR contracted or implied?

Should usage-based or outcome-tied revenue count?

How do we measure ARR in the era of agents, AI models, or success-based pricing?

Modern SaaS—especially vertical and AI-native models—often monetize on usage, outputs, or dynamic pricing.

This makes classic ARR definitions blurry.

But instead of discarding, smart operators evolve.

They shift from treating ARR as a single KPI… to a portfolio of revenue assets, each with its own:

Predictability

Margin

Retention dynamics

And with that lens, we can start making better decisions.

First Principles: What Makes ARR Valuable?

ARR quality is a function of three dimensions:

Topline ARR alone doesn’t tell you any of this. That’s why smart operators look deeper.

The ARR Flavor Spectrum

Let’s bucket ARR into four types—each with distinct traits:

Every operator should map their base to this grid. Where does your revenue actually live?

Treat ARR Like an Asset Class

Think of ARR like a portfolio. Some assets compound. Some bleed. Some should be sold off.

Stop managing ARR like it’s a single asset. Start optimizing your mix.

How to Flavor-Grade Your Business

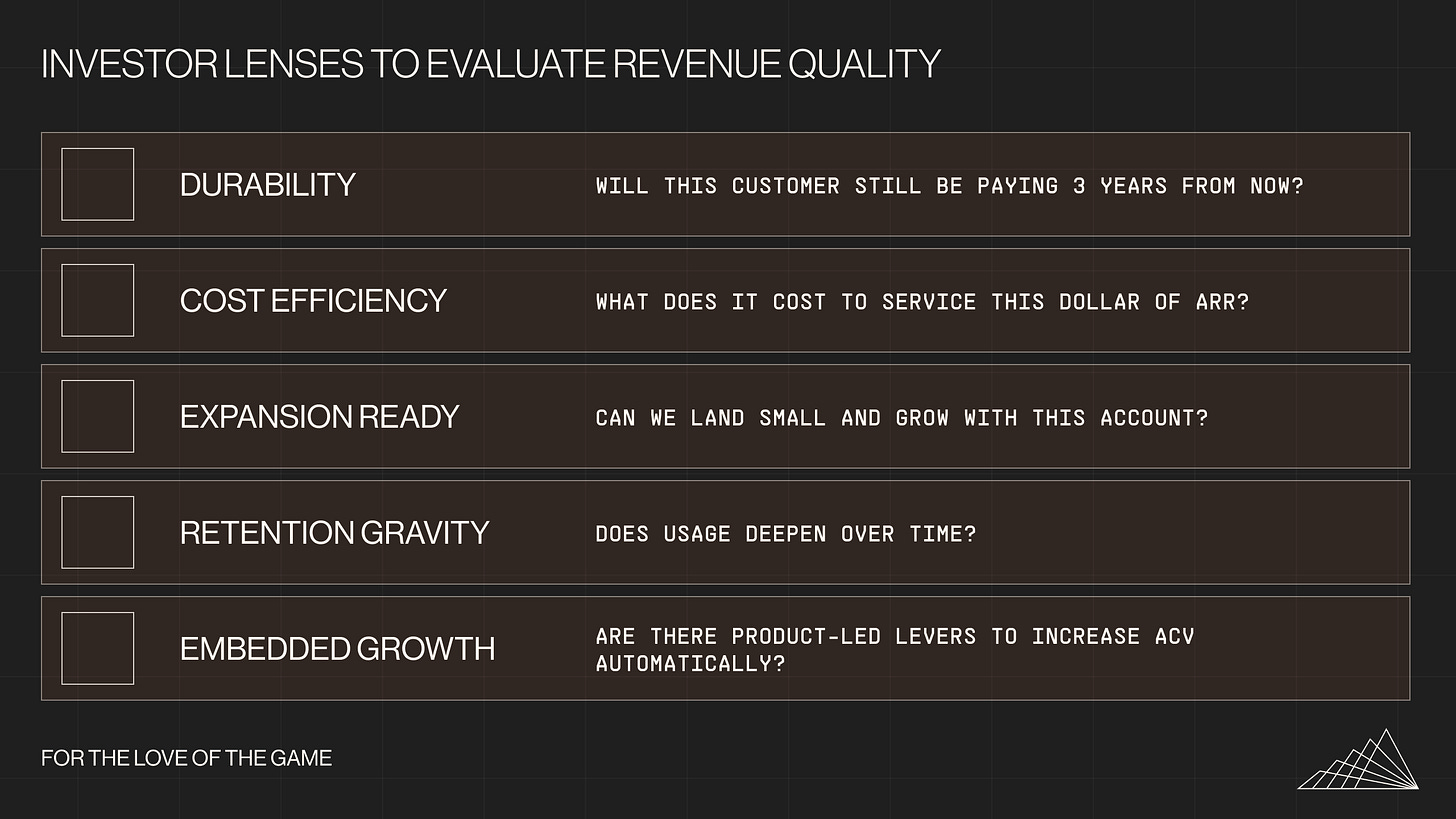

Here’s a practical lens for evaluating the quality of revenue:

Use this lens quarterly—or whenever you’re making roadmap or GTM tradeoffs.

Metrics That Actually Matter

If you're operating in a niche vertical SaaS model—where pricing may be hybrid, month-to-month, or usage-based—how do you measure ARR performance accurately?

Implied ARR

Implied ARR = MRR (Trailing 12 Months Avg.) × 12

This provides a more stable, recurring run-rate approximation—but only if used responsibly.

⚠️ Use with Extreme Caution

You should only use Implied ARR if your logo retention is exceptional—ideally above 98%. Otherwise, this metric can dramatically overstate the quality and durability of your revenue.

Even with stellar retention, avoid using a single strong MRR month to annualize performance. This creates inflated expectations and can lead to:

Overconfident budgeting

Missed forecasts

Mismatched hiring or expense plans

Always use a trailing 12-month average to account for volatility, seasonality, and one-off anomalies.

When used correctly, Implied ARR:

Offers a credible growth narrative when contracts are informal or nonexistent

Enables ARR-style forecasting and benchmarking

Brings order to messy billing realities without misleading the business

💡 Translate operational complexity into strategic clarity—but don't mistake run-rate for guaranteed revenue.

Scorecards That Reinforce Quality

Great operators use scorecards to track revenue quality, not just size. Here’s what to monitor:

Category Metrics Growth New ARR, New Logos, Expansion vs. Base Retention Logo Retention %, NRR, Churned MRR Efficiency CAC, CAC Payback, Gross Margin Sales Productivity Funnel Conversion, Avg First Order Size Profitability EBITDA, Margin vs. Plan

EOS operators:

These are your L10 scorecard essentials.

Quarterly investor update:

Implied ARR growth

Revenue mix by flavor type

Expansion vs. churn balance

% of new logos on annual contracts

The Real Win—Upgrading Your Revenue Mix

Growth still matters. But the real flex?

“We didn’t just grow revenue—we made it better.”

Better means:

Higher-margin customers

Longer retention

More expansion

Lower CAC

Easier renewals

That’s the compounding power of flavor-shifted ARR.

Ask yourself:

Are you measuring your ARR by size—or by flavor?

Which asset class are you compounding?

Where do you need to divest, upgrade, or reallocate your GTM effort?

This is how smart operators play the game now.

Not for growth-at-all-costs—but for durable, compounding value.

Start treating your revenue like an asset portfolio. Some dollars you protect. Some you grow. Some you reprice. Some you replace.

Hit REPLY and let me know what you found most useful this week (or rock the one-question survey below) — truly eager to hear from you…

And please forward this email to whoever might benefit (or use the link below) 🏴☠️ ⚡️