🏴☠️ ⚡️ Buyout Operating Models for Value Creation (Operating Concept)

We are Acquiring and Operating Micro SaaS firms in public. Join us every Saturday morning for acquisition deal case studies, operational tactics, growth frameworks, performance analysis, and more...

TABLE OF CONTENTS:

RESOURCE / CONCEPT

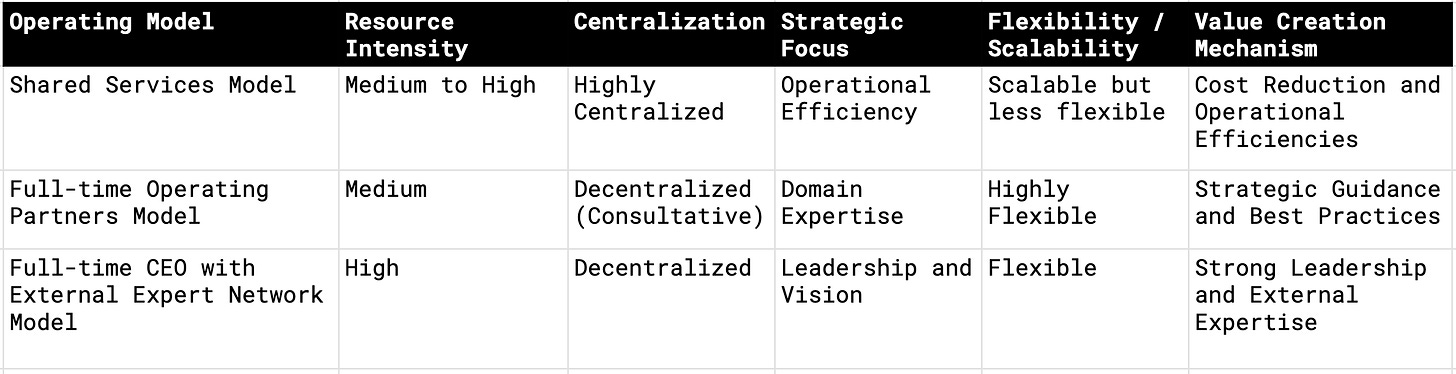

TABLE SUMMARY OF THE OPERATING MODEL LANDSCAPE

DEFINITIONS OF EACH OPERATING MODEL

DETAILED DESCRIPTION OF THE DIMENSIONS THAT DIFFERENTIATE EACH MODEL

APPLICATIONS

⚙️ OPERATING CONCEPT

📺 WATCH:

📻 LISTEN:

RESOURCE / CONCEPT:

DEFINITIONS:

Shared Services Model: This model involves centralizing standard services across the portfolio companies, such as HR, IT, finance, and marketing, to achieve economies of scale and operational efficiencies.

Full-time Operating Partners Model: This model relies on having industry or domain-specific experts as part of the firm. These experts work across the portfolio in a consultative manner to drive value creation.

Full-time CEO with External Expert Network Model: In this approach, the buyout firm places a full-time CEO to lead the acquired company and leverages a network of external experts for specialized guidance and support.

DETAILED DESCRIPTION OF THE DIMENSIONS THAT DIFFERENTIATE EACH MODEL:

Resource Intensity

Shared Services Model: Medium to high due to the need to establish and manage centralized services.

Full-time Operating Partners Model: Medium, as it relies on the expertise of a few individuals spread across investments.

Full-time CEO with External Expert Network Model: High, requiring the recruitment of top-tier CEOs and cultivating a rich network.

Centralization vs. Decentralization

Shared Services Model: Highly centralized, leveraging economies of scale by pooling resources and services.

Full-time Operating Partners Model: Somewhat decentralized, with experts providing guidance across various companies but allowing for autonomy in implementation.

Full-time CEO with External Expert Network Model: Decentralized, with a focus on leadership within the company, supplemented by external advice.

Strategic Focus

The Shared Services Model: emphasizes cost savings and efficiency through service centralization.

Full-time Operating Partners Model: leverages deep industry knowledge and domain expertise.

Full-time CEO with External Expert Network Model: centers around robust and visionary leadership supported by a broad network.

Flexibility and Scalability

Shared Services Model: Scalable for growing portfolios but may face challenges in adapting to the specific needs of diverse companies.

Full-time Operating Partners Model: Highly flexible and adaptable to the unique needs of each portfolio company.

Full-time CEO with External Expert Network Model: Flexible in addressing specific challenges and opportunities within each company.

Value Creation Mechanism

Shared Services Model: Achieves value through cost reduction and operational efficiencies.

Full-time Operating Partners Model: Drives value through strategic guidance and leveraging industry best practices.

Full-time CEO with External Expert Network Model: Creates value by instilling strong leadership and accessing external expertise.

APPLICATIONS:

The obvious application here is to determine which model fits you best or the model you’d like to pursue given your respective context, to then get after it accordingly.

Let’s start with an important assumption: the average Micro SaaS seller intends to transition from the business entirely post-acquisition. This means you need to place a CEO in every situation. Suppose it’s the case that your role in the broader equation is more akin to a financial sponsor. In that case, you are placing a full-time (or fractional CEO) who ideally comes with a solid network of agencies and contractors / freelancers. If it’s the case that you index more toward the role of Operator, the new CEO is you. And again, ideally, you have a solid network of position players you can bring in to contribute on a part-time or fractional basis.

The priority constraint now is the resources your broader portfolio provides. Put simply, the Operating Partner and Shared Services models (i.e. a full-time team of functional experts) are out of the question if you don’t have enough revenue to pay a single full-time salary. That said, you can apply these models on a contractor basis in the early days and slowly scale up until hourly contributions across the portfolio reach full-time status. Similarly, the revenues from a single Micro SaaS business likely can’t support a full-time (‘professional’) CEO. However, there may be an opportunity to fractionalize a CEO across 2 to 3 portfolio companies once you’re cooking.

Perhaps the point is that these operating models must be considered relative to your position in establishing an extensive portfolio of Micro SaaS firms (if that’s your goal).

With the above disclaimer in mind, I’ve included some actionable ways to utilize the value creation operating model framework below.

See you next time, for the love of the game…

1. Assess Acquirer/Operator Profile (you!)

Evaluate your core competencies and expertise to understand where you yourself add the most value.

Identify your resource availability, including capital, human resources, and technology, to support the chosen operating model.

Consider your strategic objectives, such as market expansion, product innovation, or operational efficiency, to determine the best fit.

2. Map Resources to Requirements

For each operating model, outline the resources and expertise needed to implement it successfully. This includes leadership capabilities, financial investment, operational infrastructure, and access to external networks.

Compare these requirements with your available resources to identify which models are feasible given your current capabilities and where you might need to invest or partner to fill gaps.

3. Analyze Strategic Fit

Evaluate how well each operating model aligns with your long-term strategic goals. For example, if rapid scaling is a priority, the Shared Services Model may offer efficiencies and cost savings that support quick growth.

Consider each model's typical challenges and opportunities and how they align with your strategic vision and risk tolerance.

4. Consider the CEO Transition Dynamics

The CEO transitions out post-acquisition, so plan for leadership continuity and knowledge retention from the outset. Choose a model that supports a smooth transition and aligns with your approach to managing this change.

Strategize around cultural integration and maintaining operational continuity during the leadership transition, ensuring the chosen model facilitates these objectives.

5. Conduct Scenario Planning

Use scenario planning to explore potential outcomes for each operating model under different market conditions, competitive scenarios, and internal changes.

This can help identify which model offers the best flexibility, resilience, and potential for value creation across various scenarios.