🏴☠️ ⚡️ Decision-Making Framework: Optimal Use of Free Cash Flow (Operating Concept)

Acquiring and scaling niche Vertical B2B SaaS firms in public 🏴☠️⚡️ —Join us every Saturday morning for value creation playbooks, operating concepts, acquisition strategies, deal analysis and more..

TABLE OF CONTENTS:

A Simple Framework for Allocating FCF

Oversimplified Example to Bring This to Life

FCF Allocation Decision-Making Framework

Decision-Making Summary Table

📺 WATCH:

📻 LISTEN:

In any business, managing cash is crucial.

The first objective is breaking even, hopefully while observing interesting growth (10%+). As things continue going well, you find yourself with surplus cash.

This extra cash—called "free cash flow" (FCF)—gives you options: you can reinvest it to grow faster, pay off debt, or provide distributions to yourself and your investors.

But how do you decide the best use of that cash?

Today, I’ll share the simple decision-making framework we use to decide where to allocate free cash flow in our SaaS business. This helps us balance competing interests across growing the company, reducing risk, and delivering on commitments to your family and investors.

The best use of FCF is entirely dependent on context. Thus, determining your context is the key challenge for making sound decisions.

Let’s dive into the framework we use…

A Simple Framework for Allocating Free Cash Flow

As noted, we consider 3x key dimensions: growth, debt (or risk profile), and investor returns.

Reinvest in Growth — if you’re SaaS is growing 30% or more, reinvesting FCF into growth is a no brainer. Acquiring market share is the base of enterprise value, which is in every stakeholder’s interest.

Pay Down Debt (aka de-lever) — If your business has taken on debt, paying it down can be a smart move. Reducing debt lowers risk and saves money in the long run, especially if you have high-interest loans. A lower debt-burden also improves the durability of the business and lessens pressure or catastrophic risk during economic down-cycles, etc.

Give Back to Investors — Investors put money into your company with the expectation of seeing a return. Sometimes, the best way to keep investors happy is to give them part of the FCF as a dividend or distribution. But take caution: this can be short-sighted if there is an obvious way to maintain growth and enhance the value of the business, where investors will reap a greater benefit in the future.

Oversimplified Example to Bring This to Life

Let’s say your SaaS does $1.5M of ARR and is growing at 20% per year. You know a 30% growth rate unlocks greater multiples and a higher valuation. 30% means adding $450K in new ARR this year.

Investment Needed for Growth: You know that for every $75K you spend on marketing and sales, you generate $150K in new ARR. To hit your $450K growth target, you need to reinvest $225K of your free cash flow (FCF).

Impact on Value: Currently, your business is valued at 3.25x ARR, giving it an enterprise value (EV) of $4.875M. After hitting 30% growth, your ARR grows to $1.95M, and your faster growth boosts your EV multiple to 5x.

Before investment: $4.875M EV

After investment: $9.75M EV

The Payoff: Reinvesting $225K in FCF increased your enterprise value by 2x! This is the case for using FCF to sustain / accelerate growth in basically every context…

Free Cash Flow Allocation Decision-Making Framework

Assess Current Business Needs and Stage

Growth Stage: If the company is still in a high-growth phase and the market opportunity remains strong, prioritize reinvestment in growth. This could include R&D, sales and marketing, or market expansion.

Maturity Stage: If business growth is normalizing or the ROI on growth initiatives starts to break down, focus more on deleveraging or providing investor distributions.

Evaluate Key Metrics (ARR, Growth, Profitability, Retention)

ARR and Growth Rate: Is the ARR growing at or above 30% YoY? If the growth rate is declining or below expectations, reinvesting FCF into customer acquisition or product expansion may be necessary to re-accelerate growth.

Profitability & Margins: If profit margins are healthy (>30%), consider whether incremental growth investments will drive meaningful returns. If profitability is low, focus on deleveraging or improving operational efficiency before expanding further.

Customer Retention & Unit Economics: High retention rates (e.g., over 90%) and favorable payback ratios suggest the business has a solid base and can scale. In this case, reinvesting FCF into growth initiatives can provide strong returns. If retention is lower or acquisition costs are ballooning, prioritize fixing customer churn or efficiency before additional growth investments.

Available Growth Opportunities

High ROI Projects: Prioritize growth initiatives that offer the highest potential return on investment (ROI). This could include expanding into adjacent verticals, launching new products, or entering new geographies. Weigh the ROI of these opportunities against their risk and cost.

Market Saturation: Assess whether the current market is reaching saturation or if there’s room for additional expansion. If market saturation is looming, shift FCF allocation towards increasing profitability or exploring new verticals, rather than doubling down on growth.

Leverage and Debt Service Requirements

Debt Levels: Review the company’s debt levels. If leverage is high and interest coverage ratios are getting tight, allocate FCF to deleveraging. Reducing debt can lower financial risk and provide greater flexibility in the future.

Cost of Debt vs. ROI on Investments: Compare the cost of debt with potential returns from reinvesting FCF. If the cost of debt is higher than the expected ROI of growth initiatives, paying down debt should take priority. Conversely, if growth projects offer significantly higher returns than debt costs, reinvestment may be more advantageous.

Investor Expectations and Timing

Short-term vs. Long-term Returns: Align your FCF allocation with the expected timelines of investors. Some investors may prefer immediate distributions, while others may value long-term appreciation. Set clear communication with investors on distribution timing, especially if pursuing high-growth opportunities that may delay distributions.

Opportunistic Distributions: Consider distributing cash when the company hits certain milestones or when FCF exceeds reinvestment needs. This can maintain investor goodwill while allowing you to pursue long-term growth.

Dividend Policy: Establish a flexible dividend policy that allows for both growth and income. For example, you could commit to distributing a portion of excess FCF after covering growth investments and debt obligations.

Risk Management and Economic Environment

Market Conditions: If the economic environment is uncertain (e.g., rising interest rates, recession fears), prioritize deleveraging to protect against downturns. Having a stronger balance sheet and lower debt allows for greater flexibility during market turbulence.

Cash Reserve: Maintain a healthy cash reserve to ensure liquidity for unforeseen challenges or market opportunities. Allocate FCF to building this reserve if it is currently low.

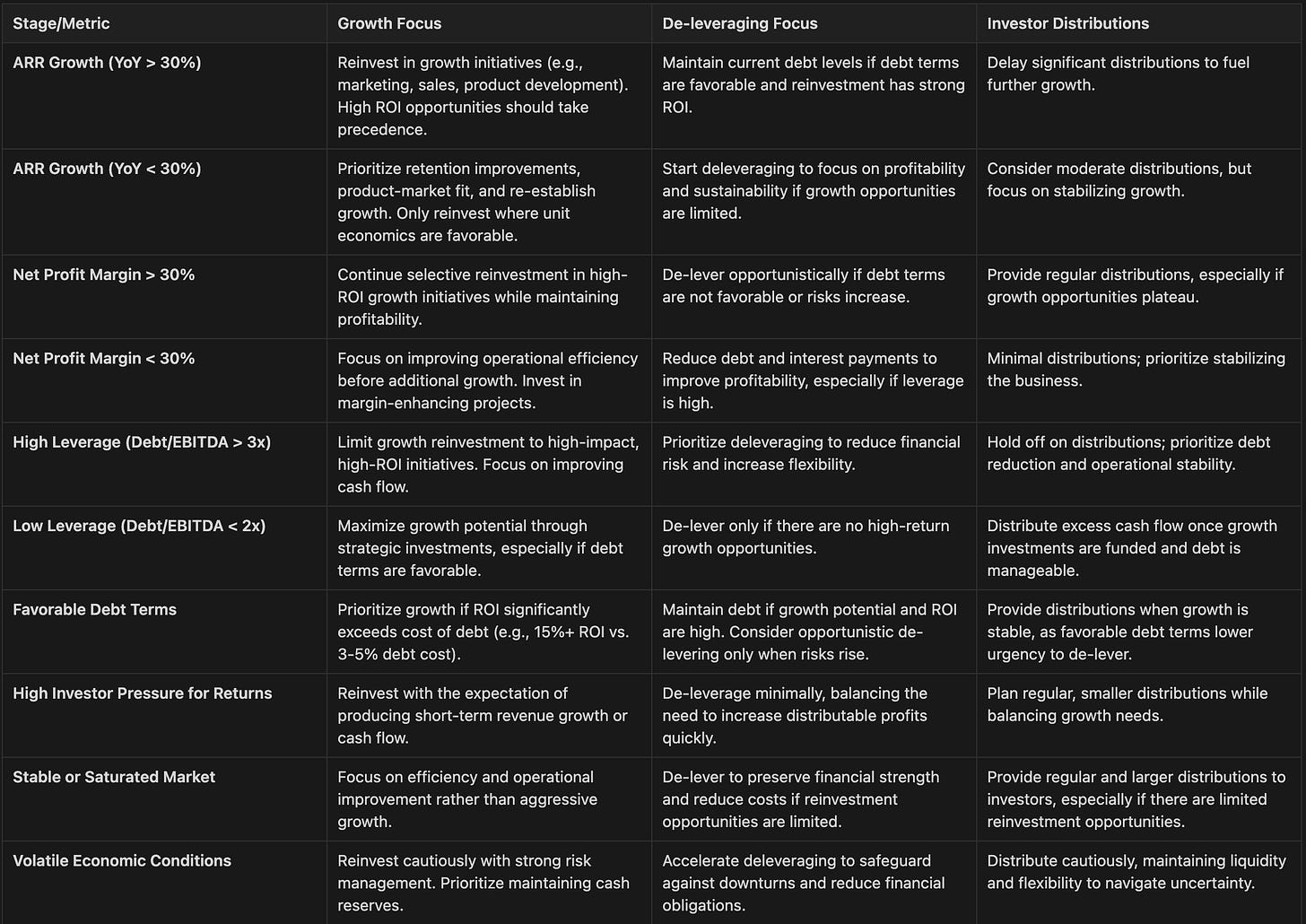

Decision-Making Summary Table

Hit REPLY and let me know what you found most useful this week (or rock the one-question survey below) — truly eager to hear from you…

And please forward this email to whoever might benefit (or use the link below) 🏴☠️ ⚡️