🏴☠️ ⚡️ Issue #11: Commercial Pool SaaS & Content Operating Model

Welcome! This newsletter is dedicated to acquiring and operating Micro SaaS firms. Join us every other Saturday morning for deal analysis, operating frameworks / templates, and other musings...

Our community is growing and simply THRILLED to have you with us. This is a fairly packed issue with a textbook vertical SaaS deal, a proprietary Skaling Ventures framework, and links to 2x guest podcast episodes that discuss the wide world of Micro SaaS in great detail. Hope you dig!

🎯 ACQUIRE — Project and business management platform for the commercial pool industry with $21k MRR

⚙️ OPERATE — An iterative framework for developing content to utilize across all go-to-market activities

🤔 MUSINGS — 2x guest podcast sessions covering Skaling Ventures, Micro SaaS, Operating frameworks / principles, and beyond

🎯 ACQUIRE

// DEAL TEAR DOWN

FIRM PROFILE (PUBLIC LISTING)

“SaaS with $262,000 in TTM revenue and $18,000 in revenue last month that features a robust project and business management software platform that has been exclusively designed and developed for swimming pool industry professionals”

ASKING PRICE: Open to Offers

TTM REVENUE: $262K

FOUNDED: 2015

REVENUE MULTIPLE: 2 to 3x (requested)

TTM PROFIT: Unknown

TEAM SIZE: 6 FTEs

PRODUCT STACK: Python and Javascript

GROWTH: Unknown

SV SCORECARD AVERAGE

💥 2.41 / 4

STRENGTHS

SOLID SECTOR OUTLOOK — Commercial pool operators and participants have embraced technology and innovation over the last five years, which is a signal they are open to SaaS solutions for general operations. In addition, the sector is ripe for consolidation, presenting an opportunity for a SaaS to become the ‘solution of choice’ to support M&A activities (aka systems integration), which creates a natural growth lever for MRR. Lastly, global expansion seems very interesting as well. Here are some additional details to support the above:

Technological advancements: The commercial pool industry has seen significant advancements in technology in recent years. Innovations in pool construction, water treatment, heating, and maintenance systems will continue to drive efficiency and cost savings, making commercial pools more attractive to potential operators.

Market fragmentation: The commercial pool industry is relatively fragmented, with numerous small and medium-sized players. This provides an opportunity for consolidation, judging by the evolution of categories with similar characteristics at this stage of maturity.

Urbanization and population growth: Rapid urbanization and population growth in emerging economies will create demand for recreational and wellness infrastructure, including commercial pools. This is expected to spur growth in regions like Asia, the Middle East, and South America.

CUSTOMER LTV — With a stated Customer LTV of $16.7k, you have lots of room to experiment with acquisition channels / tactics. Said another way, you can invest up to $16.65k to acquire a customer and still be profitable at the unit economics level. Additionally, these LTVs are sufficient to support sales-led-growth (SLG) (aka hiring sales people to attack the market), though that is not part of our go-to-market (GTM) model.

HORIZONTAL INCUMBENTS — There are only ~2 vertical competitors providing similar SaaS catered specifically to commercial pool developers and operators, the rest are horizontal players catering to general construction management. In sum, it is early innings for the emergence of vertical players, with this company positioned well in the hunt…

RISK FACTORS

PROFIT MARGIN — The profit margin is undisclosed, which is not common and a yellow flag. We must always assume there is an opportunity to change the cost structure via pivot to fractional team members, generative AI, automation, etc. It is also common the Seller is overpaying themselves, or stripping out profitability via distributions. Regardless, we need utter confidence there is margin available to a) service the debt used to acquire the business and b) finance transformation activities.

REVENUE CHURN — At Skaling Ventures, we seek to essentially buy product market fit (PMF). Churn is one of the most critical metrics to validate PMF. In other words, customers don’t leave / churn products that solve the job(s) to be done. At ~$21.8k MRR and 12% churn, this acquisition target is in the bottom quartile for churn measured against comparable peers. First priority in due diligence is to decompose churn to understand if it is centered around a certain customer profile or product feature, etc. Bottom line, we need to be super clear on where the churn is coming from and have confidence it is solvable.

QUICK WINS & OPPORTUNITIES

IMMEDIATE EXPANSION REVENUE — Assuming this company has a few distinct product offerings, we could focus on expansion-driven revenue out of the gate, where you:

Identify the customers that are only utilizing a subset of your SaaS products

Identify the attributes and signals that prompted other customers to buy more / all of your available products

Target the customers from bullet no 1 above accordingly and get some outbound going

Expansion revenue is GLORIOUS, in that you are leveraging goodwill / trust with existing customers, which equals shorter sales cycles / quick pops in MRR, though expansion revenue is a finite pool (pun intended 😉).

SEQUENCED ACQUISITION / REVENUE BASED ON VALUE LADDERS — Following on the above, and if you recall the bit on Value Ladders as an operating tactic from issue #7, this company presents a strong case for sequencing revenue growth for any given customer. In sum, you’d start by selling the most basic, low friction product you provide. You then monitor the success of the customer (now with unique access to their usage and operations, etc.) to then kick off an up-sell / expansion campaign to slowly sell all products and fully penetrate the account over time. This is a ‘land and expand’ strategy…

MARKET COMPS

Micro SaaS with ARR: $250k to $300k

~Asking Price: $1.15M — ⬇️ ⬇️

~Revenue Multiple: 3.66x — ⬇️⬇️

~TTM Profit Margin: 62.77% — ❓🤷♂️

~Growth Rate: 34% — ❓🤷♂️

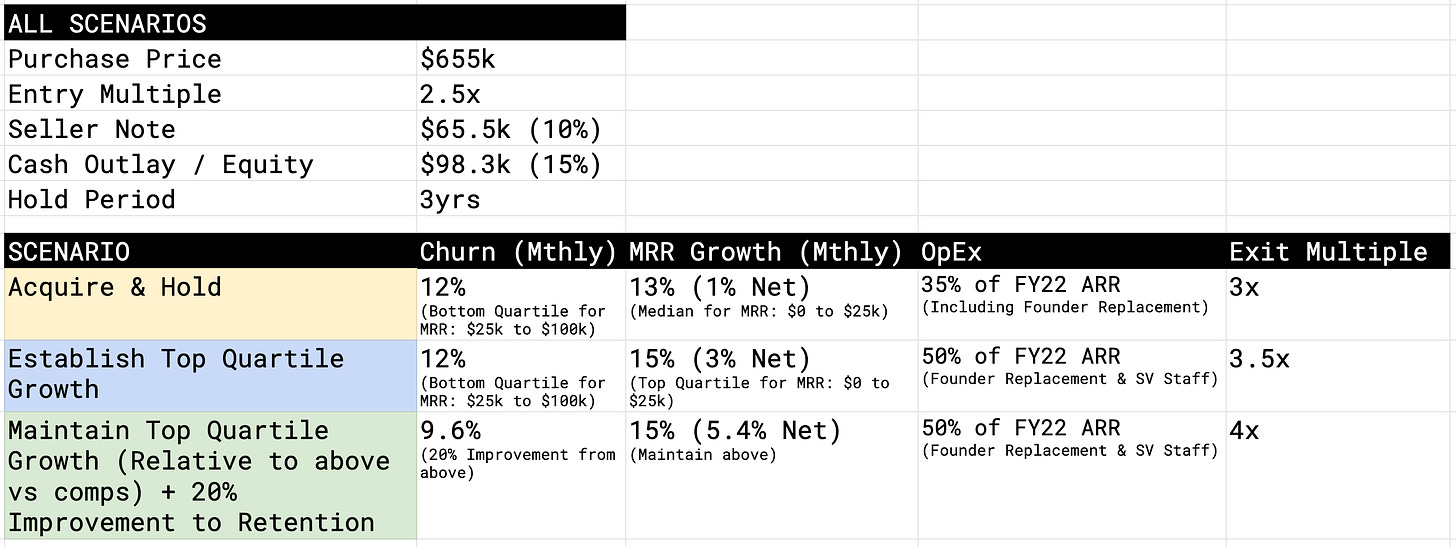

RETURN SCENARIOS

ASSUMPTIONS -

RETURNS -

Disclaimer: The assumptions and returns for the third scenario above represent an extraordinary level of difficulty. Achieving 3% net growth (top quartile for the peer group) requires 15% growth to offset the effect of churn and that is AMAZING growth. The third scenario assumes we are able to maintain an absolutely elite growth rate and then solve for churn, which has an exponential impact on growth. This is a good case in point that retention (aka reducing churn) is the name of the SaaS game…

⚙️ OPERATE

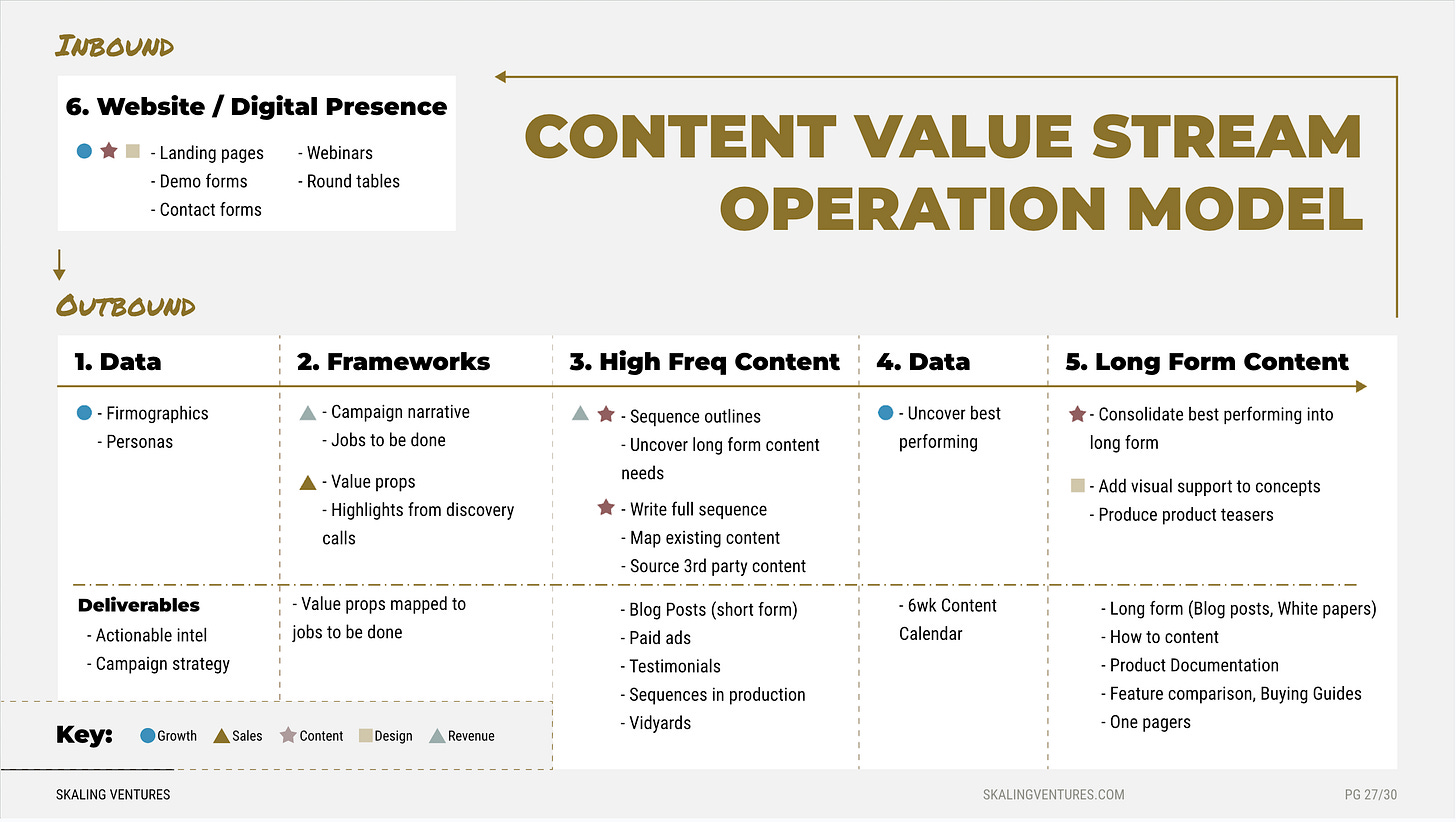

RESOURCE - Content Value Stream Operating Model

APPLICATION(S) -

This is a doozie, though it’s one of the most impactful frameworks we’ve developed. It provides a data-driven starting point for generating content and a means to realizing a ton of leverage from all efforts, as the entire framework is a feedback loop that builds on itself and improves over time.

Simply put: firmographic data points and other attributes define your audience > > jobs to be done help create value props for this audience > > high frequency content is a testing ground to find the content and value props that slap > > this informs longer form content > > which can be applied to your digital presence to improve the pull on your audience over time.

🧐 Musings

Mixing it up this week - see below for 2x guest podcast sessions from last month, which cover a wide spectrum of topics like:

what drew me to micro SaaS after a career spanning big corporate, venture backed, consulting and PE sponsored

GTM principles and frameworks regardless of the business stage or context

The transition to investor / operator…