🏴☠️ ⚡️ Issue #15 - Deal Tear Down: Software Suite for Wedding Venues with $98k ARR

Welcome! This newsletter is dedicated to acquiring and operating Micro SaaS firms. Join us every Saturday morning for a chapter of this month's issue...

Welcome back!

This month, we are officially transitioning to a weekly newsletter providing a chapter of the issue. The hope is to provide more consistent and digestible content.

Let’s get on with the show, starting with this issue’s Deal Tear Down…

Part 1 — 🎯 DEAL TEAR DOWN - Software Suite for Wedding Venues with $98k ARR

Part 2 — ⚙️ OPERATING CONCEPT - A honey pot of investment memos from BVP

Part 3 — 🛠️ OKR TEAR DOWN - Partner Enablement to Drive Trial Sign Ups

Part 4 — 🏆 PORTFOLIO PERFORMANCE WRAP - Sprint #3 Highlights & Learning

🎯 DEAL TEAR DOWN

📺 WATCH:

📻 LISTEN:

FIRM PROFILE

“Profitable SaaS with $86,000 in TTM revenue and $33,000 in TTM profit that helps wedding/event venues bring their entire operation into one software suite. Huge TAM and incredible opportunity to become the market leader in this niche, growing industry.”

ASKING PRICE: $750k

TTM REVENUE: $86k

FOUNDED: 2017

REVENUE MULTIPLE: 8.7x

TTM PROFIT: $33k

TEAM SIZE: 2

PRODUCT STACK: React, Firebase, AWS

YoY GROWTH: 5%

SV SCORECARD AVERAGE

💥 2.58 / 4

STRENGTHS

CLASSIC PLATFORM VS POINT VALUE PROP — As industries adopt technology, they tend to acquire tools based on an acute pain point (think: invoicing > email marketing, etc.). Over time, these tools accumulate, leading to data silos and a ton of friction, quickly offsetting the efficiency they were intended to create. At this point, ‘platforms,’ which consolidate point solutions into a cohesive suite of integrated Software typically enter the picture and can acquire market share quickly. We like this general value proposition a lot…

MODERN PRODUCT TECH STACK — More often than not, the game of Micro SaaS involves dated tech stacks and significant tech debt. After all, boot strapped founders are among the most resourceful humans on the planet so expect a fair share of bubble gum and duct tape. This circumstances lend to recurring support issues and can hold back new feature releases, etc. This firm’s product tech stack seems mostly unencumbered.

USAGE BASED PRICING — We LOVE usage based pricing because it scales linearly with the value a user receives (vs user-based pricing or some fixed fee based on an arbitrary value container). It’s exciting to see the market is receptive to / bearing pricing based on number of events per year. The bummer is we can’t run this play as part of the value creation thesis 😔…

LIGHT OPERATING MODEL — A 2x person headcount is impressive and speaks to the operational efficiency and aptitude of the seller. It also implies a light support burden and decent organic growth. We would still look to pivot all fixed costs to variable via a contractor / fractional labor model.

RISK FACTORS

VALUATION AND REQUIRED DEBT SERVICE — The seller is asking for a pretty ambitious multiple here, likely underpinned by conviction re a modern product infrastructure that is primed for scale. Regardless, this valuation juices the debt required to execute the acquisition per our conventional deal structure and the business doesn’t generate enough revenue, let alone income, to service the debt. Bottom line - this valuation is a deal killer, unless we bring much more cash / equity to the deal. In the simplest sense, winning in private equity is a function of buying low and selling high. At exit, it would be difficult to command a higher valuation (even if we achieve top quartile performance across key metrics), though that valuation would ideally be applied to a greater revenue figure after growing the business (think: 8.7* $85k vs 8.7* $200k) so there is a generally return potential on the table. That said, this deal doesn’t fit our model and is likely a non-starter.

RESOURCE INTENSIVE ONBOARDING — “White Glove” is mentioned a lot in the firm brief, which raises concerns that the onboarding process is not user-led. In this scenario, getting a new account off the ground requires a team to configure the software, which costs money and time. This can devastate unit economics and extend the timeline until a customer is profitable for the business. In a similar vein, this creates resourcing issues, where you have to scale up / down an implementation team based on the backlog of new customers. This is VERY tricky to forecast and can create implementation bottle necks that frustrate customers.

QUICK WINS & OPPORTUNITIES

COMPETITIVE SET FOCUSED ON OTHER SEGMENTS — A quick search on G2 reveals that there is indeed a concerning competitive set, though most seem to be focused on the restaurant vertical. This makes sense, as most restaurants scramble to generate new income streams from their spaces via private events and the like. This does support the point of view that this firm is well positioned to deeply penetrate wedding and other (non-restaurant) event venues. Here’s a quick look at the most interesting player:

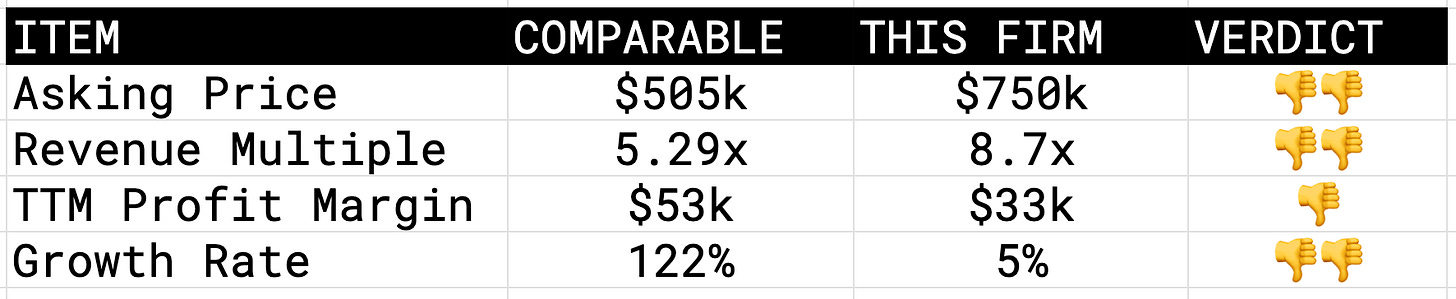

MARKET COMPS

Micro SaaS with ARR: $50k to $100k

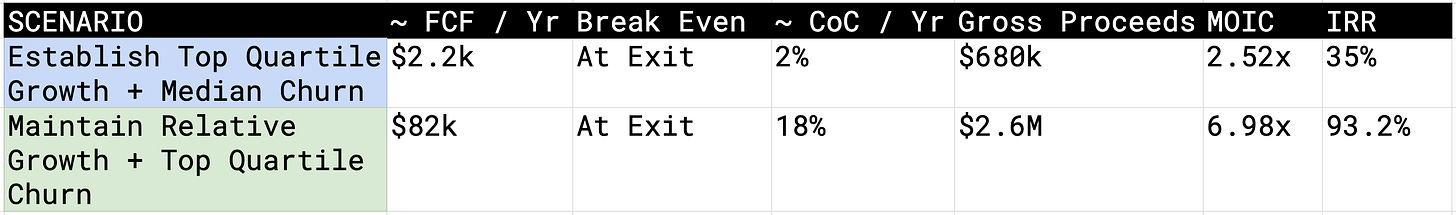

RETURN SCENARIOS

ASSUMPTIONS -

RETURNS -

Very cool, thanks for this analysis! Would be really interesting to have another one in the same MRR category, but which is actually a good deal :)!