🏴☠️ ⚡️ Issue #18 - There's a Reason Most Neglect Pricing (OKR Teardown)

Welcome! This newsletter is dedicated to acquiring and operating Micro SaaS firms. Join us every Saturday morning for Deal Teardowns, Operating Concepts, and more!

TABLE OF CONTENTS:

Part 1 — 🎯 DEAL TEARDOWN - Digital Credential Management SaaS doing $41k MRR

Part 2 — ⚙️ OPERATING CONCEPT - 2x OG Growth Frameworks to Live By

Part 3 — 🛠️ OKR TEARDOWN - Full Refresh of Pricing and Monetization

Part 4 — 🤔 MUSINGS - TBD

🛠️ OKR TEARDOWN

📺 WATCH:

📻 LISTEN:

As a point of departure, I’ve included the full OKR below to set the foundation for a teardown of our approach thus far…

OBJECTIVE: New pricing model improves monetization by >15% MRR

KEY RESULTS:

Analyze feature usage to determine distributions and value metric to establish core customer segments and inform working hypothesis for new pricing plans

Execute competitive audit to inform view on new plans in context of market landscape (ie negative impact to trial users and paid user conversions, etc.)

Determine user impact (% of users moved to new plan and $ change), break even point (spectrum of MRR and Churn sensitivity) and revenue (net effect at base case)

Identify top 3 risks of transitioning users to new pricing plans, create mitigation plan

Execute pricing plan transition operations (stripe, product back-end, in-app experience)

Execute multi-touch / channel communication strategy (3x email, 3x facebook group) to ensure awareness

Provide FAQ document / templates to support to navigate related convos in best practice manner

Set up alert to monitor negative sentiment (Social / review monitoring) and template responses

ESTABLISHING TERMS AND FOUNDATIONAL CONCEPTS

In the simplest terms, our job as operators is to create, deliver and capture value. Unfortunately, most of our energy is pointed at the creating and delivering value bits. Said another way, it’s very rare that a 3rd of our effort is directed at capturing value, let alone is it considered on a regular basis, so it’s likely we’ve neglected pricing and monetization to some degree.

Separately, I want to remind us all of the context in Micro SaaS. This is not startup land where we are pursuing product market fit and testing a low confidence hypothesis re pricing sensitivity, willingness to pay, etc. We all inherit a body of product usage, historical subscriptions, etc. Put simply, there is a TON more data to put to work. Okay, on with the show…

Pricing, Packaging & Positioning

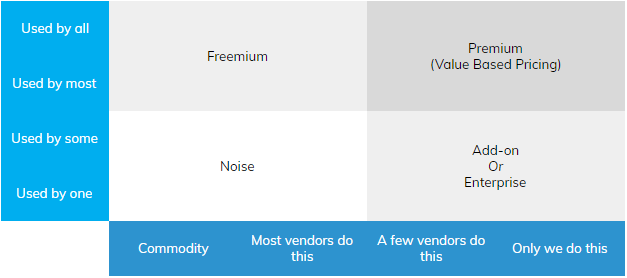

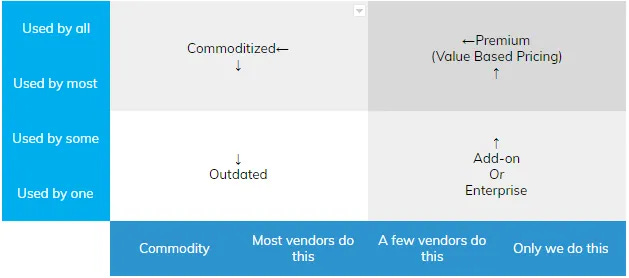

Below is my favorite visual guide for the macro elements we have to work with: Pricing, Packaging and Positioning. This also shines a lot on the #1 principle of pricing design - ‘Do not price your product, price your customer / segments’.

(Source)

Pricing Levers / Mechanisms

From here, let’s add a LOT of complexity by looking at the pricing levers / mechanisms that are typically available in SaaS. I won’t go into too much detail here, as this merits a post of its own, but there is a lot at our disposal.

(Source)

In context of Value Chains

As you consider the most appropriate pricing mechanisms, it’s critical to keep the respective value chain front of mind. Your ultimate goal is to align the long-term success of your users with the cost they pay for your SaaS doing the job-to-be-done. Furthermore, be weary of indexing too hard toward outputs / outcomes at the end of the value chain, as that will hinder near-term cash flows / monetization to the detriment of your entire business. On the other side of the coin, indexing too hard toward inputs can synthetically prevent your users from adopting SaaS and realizing the outcomes that create the most value.

The example below highlights the point above, where charging for users could hinder the number of models deployed, which generates the critical business outcomes for users…

(Source)

A simple example to bring it altogether

The below was SUPER useful when I started my pricing journey so I’d be remiss to not include it here. Hopefully this ties many of the foundational concepts above together.

(Source)

MOST USEFUL FRAMEWORKS & EXERCISES

Now that we have macro concepts and micro mechanisms at our disposal and have grounded our thinking in the context of our user’s value chain, let’s move on to frameworks and exercises to help shape a comprehensive pricing plan design.

Product Feature Matrix

Before tackling this matrix, I encourage you to scrape direct competitors’ pricing pages to inform a universe of relevant features. End the competitive analysis there, though, until we circle back per final steps. Your users and product usage data should guide a large portion of strategy.

The examples below demonstrate the type of scatter plot you’re trying to create, where each feature lands in a respective quadrant. No need to get fancy, you can use a simple 1 to 4 numerical score. The features that score a 4 on both dimensions are ‘Premium’, and so on.

In our context, a majority of features fall in the commodity / most category so we went with an x-axis based on feature value, which we based on the pricing plan a respective feature fell into from amongst our competitive set. Features in the premium plans receive higher scores and vice versa.

(Source)

Pricing Tiers based on Distributions

At this point, we created histograms to show the distribution of each feature. This will help you identify concentrations / patterns. ChatGPT’s ‘Advanced Data Analysis’ plug-in will save you a ton of time rendering the histograms. For the more advanced folks you can execute cluster analysis to gather the same insights.

Ideally, certain patterns and features become obvious candidates for your core value metrics (ie the features / usage that has the biggest impact on plan design).

As an example, let’s say you are looking at an ‘invoicing’ feature: 60% of users send 1000 invoices a year, 20% send 250 invoices a year and the remaining 20% send 3000+. You can now start to assign features to a segment of the bell curve, illustrated below, where your core segment falls in the middle / hero plan.

Rinse and repeat until pricing plans / packages start to take shape.

(Source)

You can now combine the insights from the product feature matrix and the hero distribution curve to inform macro plan decisions on a feature bundling basis. In the example below, Plan 1 is the Decoy, and so on. Once this is generally in order, it’s time to overlay any usage based components (perhaps volume of ‘invoices’) and add-ons (like a deep integration with accounting software).

(Source)

Competitor Audit

As touched on above, focus on your customer > focus on your competitors, though pricing strategy must not happen in a vacuum. Hopefully, establishing a universe of relevant features and most common feature distribution across competitive pricing plans didn’t bias the hell out of your thinking or you’ll likely end up with more of the same. Assuming you took a user-centric approach, this exercise is mainly meant as a sanity check and insurance you aren’t missing on deeply established purchasing behaviors and user expectations.

Here were the competitor attributes we consolidated into a simple spreadsheet so we could quickly compare / contrast:

Core segments - How have they defined and distinguished their customer segments?

Entry Price - What’s the cost of the decoy plan?

Cost Variance - What’s the cost difference between the decoy and anchor plan?

Usage Based Features - what are they?

Premium Features - what are they?

Offers and Discounts - how do they incentivize commitment and decisioning?

CONCLUDING THOUGHTS

Pricing is an extremely valuable and critical component of GTM strategy, and thus, a very meaningful lever to study and master as a Micro SaaS Acquirer / operator.

Changing pricing and monetization also bears a lot of risk. If you miss big time, churn will explode. It’s a high stakes thing that will certainly leave you feeling alive. Outside of doing your homework and utilizing the best frameworks you can get your hands on, much of the success relies upon communication strategy and ‘user relations’…if there is such a thing :)

A minimum of 1x month heads up with details on what motivated the change / the rationale, the impact it has on a respective user and how to make changes are all standard. Here’s an awesome collection of price change email teardowns.

Upon making the announcement, treat the next 24-48hrs as ‘crisis response’ mode where your job is to empathize and objectively hold the line based on the rationale and long term interest of everyone involved. Furthermore, expect some very useful feedback to emerge and plan for user-wide follow-up / mass communication at the end of that 48hr period to address confusion and provide relevant resources (like support articles on how to change stuff that informs pricing). It's a matter of standing by your initial communication, which is well researched and thoroughly constructed, and if it’s any good it should have your back in terms of rationale. Your ‘crisis response’ is how you humanize that rationale and let your customers know you are listening.

Lastly, I’ve found executing pricing changes to be one of the most difficult things in business. You will feel very alone. Every negative comment will catalyze an emotional reaction. You’ll be terrified everyone is going to leave. There will be some positive bright spots and encouragement. Then, the dust will settle. You’ll realize the vocal minority is a false representation of the average reaction. Negative comments do not translate to churn. Ideally, you’ve improved goodwill by being responsive and acting on feedback.

Then MRR is a far better representation of business value and away you go…until you have to revisit pricing again, as the best operators do 🏴☠️ ⚡️