🏴☠️ ⚡️ Issue #19 - The Flavors of a Buyout Investment Thesis (Operating Concept)

Welcome! This newsletter is dedicated to acquiring and operating Micro SaaS firms. Join us every Saturday morning for Deal Tear Downs, Operating Concepts and more!

TABLE OF CONTENTS:

Part 1 — 🎯 DEAL TEARDOWN - [Off-Market] Established SaaS for Countertop Fabricators

Part 2 — ⚙️ OPERATING CONCEPT - The Flavors of a Buyout Investment Thesis

Part 3 — 🛠️ OKR TEARDOWN - Execute UGC Tactical Experiment to Inform Longer-term UGC Strategy

Part 4 — 🤔 MUSINGS - TBD

⚙️ OPERATING CONCEPT

📺 WATCH:

📻 LISTEN:

RESOURCE / CONCEPT:

(Source)

APPLICATIONS:

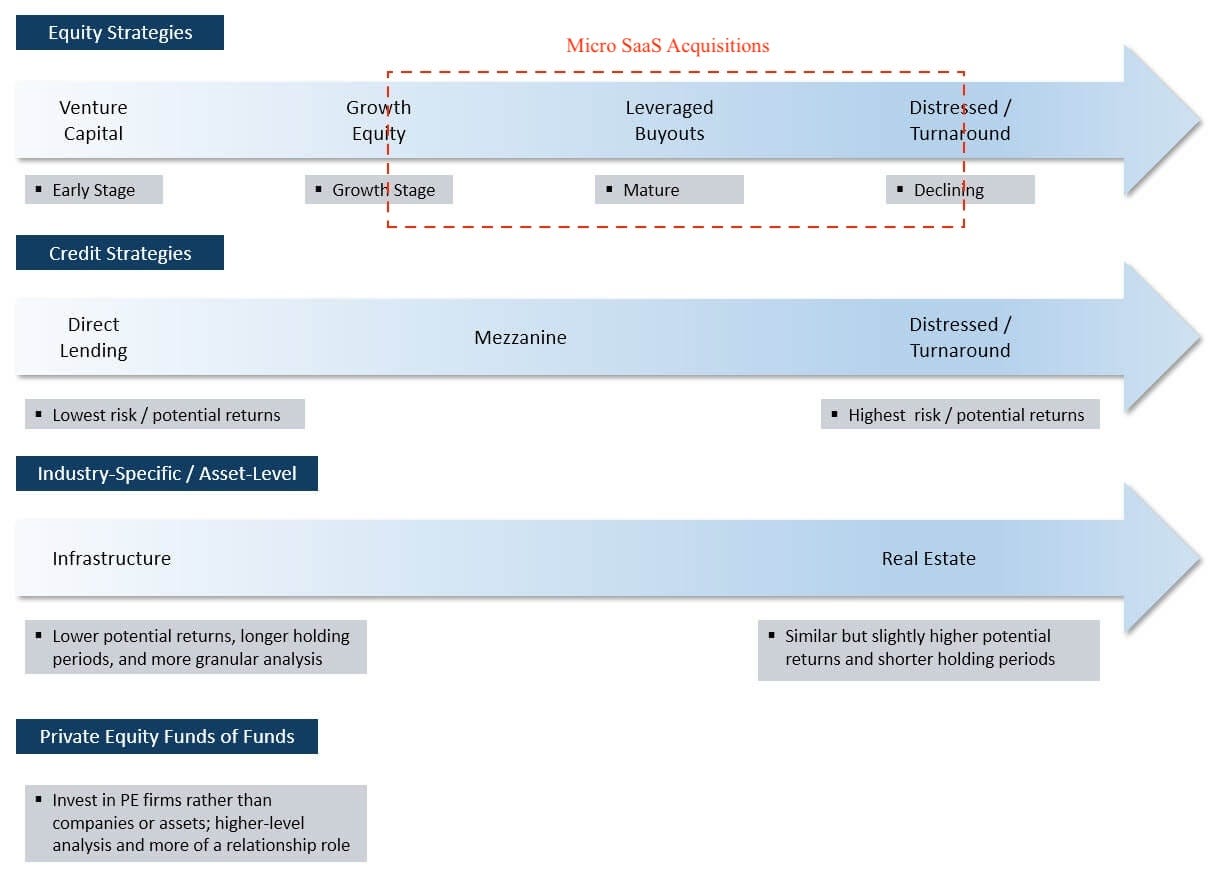

We’ll be looking specifically at ‘buyout’ strategies, though there is definitely a bit of ‘growth’ thinking in the Micro SaaS context (see the red box above for visual representation in broader landscape). One thing is certain, we are not targeting high growth sectors, or horizontal SaaS firms tackling $B dollar TAMS. These areas are squarely within the confines of Venture Capital and Growth Equity. That said, there is a ‘growth’ component to every Micro SaaS thesis, where the assumption is a lack of resources, frameworks, etc. has historically prevented growth potential.

Now that we’ve added a bit of context, let’s dive into the flavors of investment thesis at our disposal:

Top-Down, Thematic Investment Thesis: This approach starts with a broad macroeconomic view, identifying sectors or themes expected to outperform due to underlying trends. Investors then drill down to find companies within these sectors. Key factors might include demographic shifts, technological advancements, or regulatory changes. As an example, many investors used COVID as an event, which would predictably pull forward / catalyze trends like working from home, home fitness, entertainment consumption, etc. With this top-down view, one could then target individual firms positioned for outperformance (think: standing desks, home gym equipment, etc.).

Sector-Specific Investment Thesis: Here, investments are concentrated in a specific sector or industry. The investor typically has deep knowledge or a strong belief in the growth potential (or stability) of this sector. This is bread and butter vertical SaaS.

Bottom-Up Investment Thesis: This is the opposite of the top-down approach. Investors start by identifying individual companies that exhibit strong fundamentals, unique competitive advantages, or growth potential, irrespective of broader industry trends or economic conditions. The deal tear down from last week is a good example here.

Roll-Up (Bolt-On Acquisition) Strategy: This strategy involves acquiring multiple smaller companies in the same market and merging them into a single entity to gain synergies, increase market share, and improve operational efficiencies. The goal is to create value by combining the strengths of each company, achieving economies of scale, and enhancing the overall competitive position. This approach is often used in fragmented industries where consolidating several smaller players can lead to significant cost savings and revenue growth opportunities. Roll-up strategies can be particularly effective when combined with leveraged buyouts, where the acquisitions are financed with a significant amount of debt relative to equity. I suspect we will see a lot more of this in Micro SaaS.

Turnaround Investment Thesis: This involves investing in companies that are performing poorly or are in financial distress, with the aim of turning around their fortunes through strategic, operational, or managerial changes. This is not for the faint of heart, though it’s very present in Micro SaaS for those with the financial padding to buy time for executing the turnaround. If successful, the value creation is insane, as the purchase price / entry point is much lower.

Opportunistic Investment Thesis: Here, the focus is on identifying undervalued or distressed companies regardless of industry or macro trends. The goal is to acquire these companies at a discount, improve operations or financial structures, and sell them for a profit. This approach requires flexibility and a keen eye for spotting unique opportunities. I’d like to suggest this is at play in every Micro SaaS deal. The category itself is more rooted in established financial sponsors who are beholden to a specific mandate, and thus, require a fund like this to exploit opportunities that don’t fit neatly into an established fund mandate. Put simply, these funds most often exist as a catch-all for the great deals a sponsor uncovers, which they can’t rationalize to LPs based on the available fund mandates.

This issue is definitely a departure from the operating concepts we feature, which are catered squarely to operating a SaaS firm. That said, those playing the ‘acquire and operate’ game should be clear on how the market will interpret their investment thesis. Further, it’s useful to use language that is already defined and common place to accelerate fund raising activities and beyond by speaking the language of LPs. We hope this is useful in that regard. Please let us know in the comments if you’d like to see more substance from the investing side of the fence…

For the love of the game.