👌 Issue #6: Q422 Acquisition Pipeline Teardown & Transformation Roadmap (Notion Template)

With acquisition #1 set to close mid-February (🚀 more to come here! 🚀), this issue will index harder to the OPERATE section, as we establish the transformation road map and begin executing on the investment thesis.

Let’s dive in…

🎯 ACQUIRE — Q422 Pipeline Breakdown looking at cumulative deals added, end stage and patterns

⚙️ OPERATE — A notion template laying out example activities, sequencing and categorization (drawn mostly from acquisition #1)

🤔 MUSINGS — ‘Discipline = freedom’ vs ‘bend don’t break’

🎯 ACQUIRE

// Q422 Acquisition Pipeline Teardown

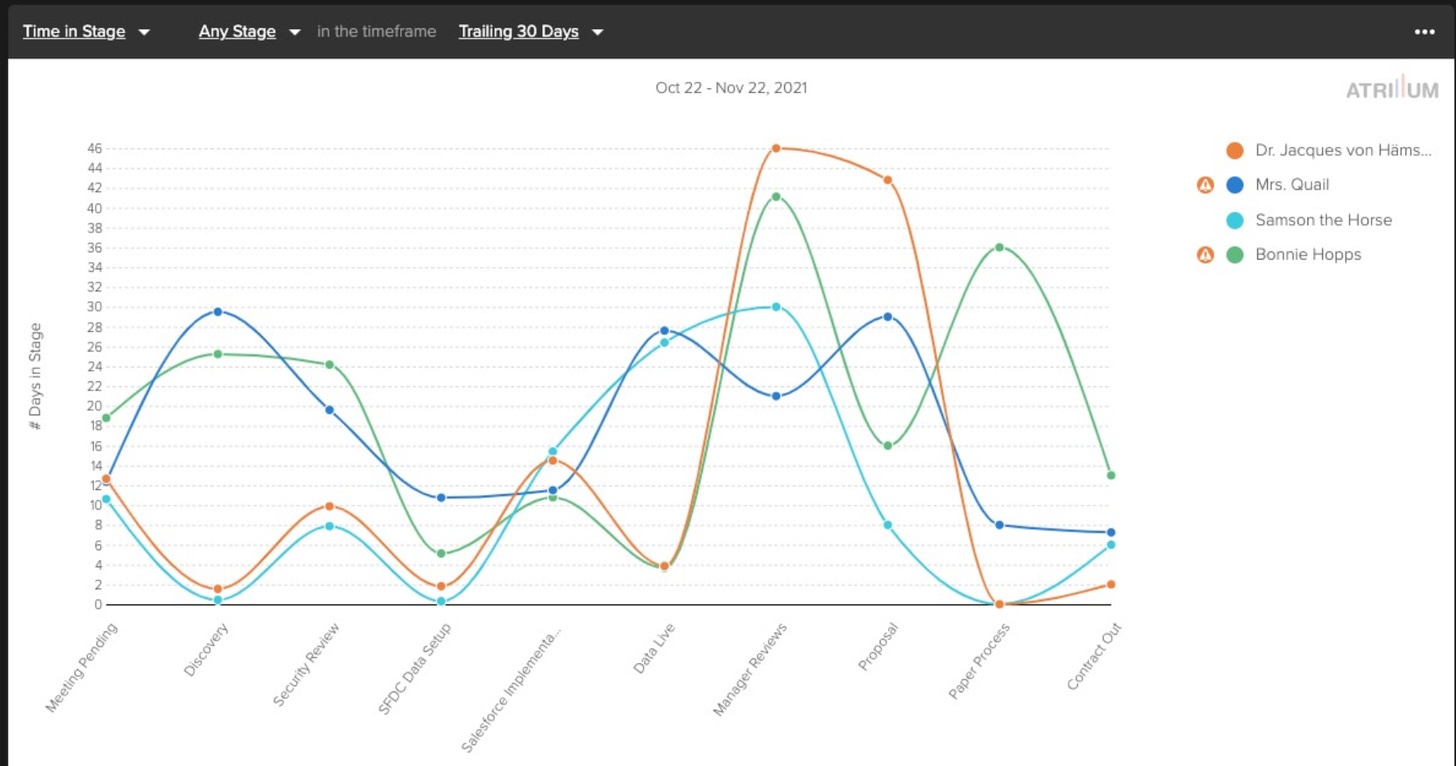

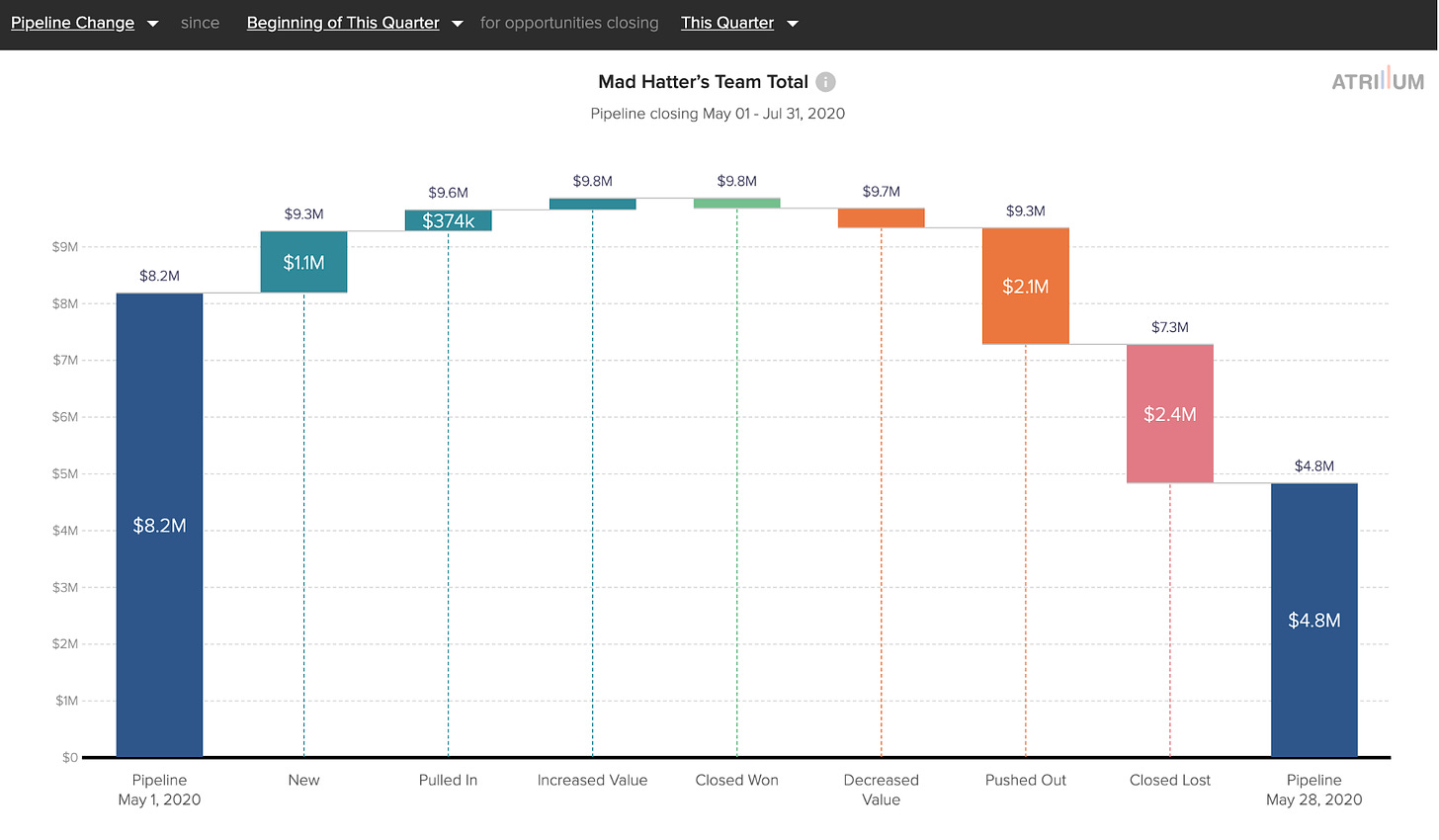

Quick disclaimer: analyzing a pipeline via end state / stage can tell you a lot about volume and patterns across a sample of deals (e.g. average asking multiple, etc.). But it doesn’t help answer questions like: at any given point in time, how many deals did we typically have under LOI? What is the conversion rate from stage A to stage B? What stage takes the longest? (though this would obvi be diligence 😜) Here are some examples to illustrate the point

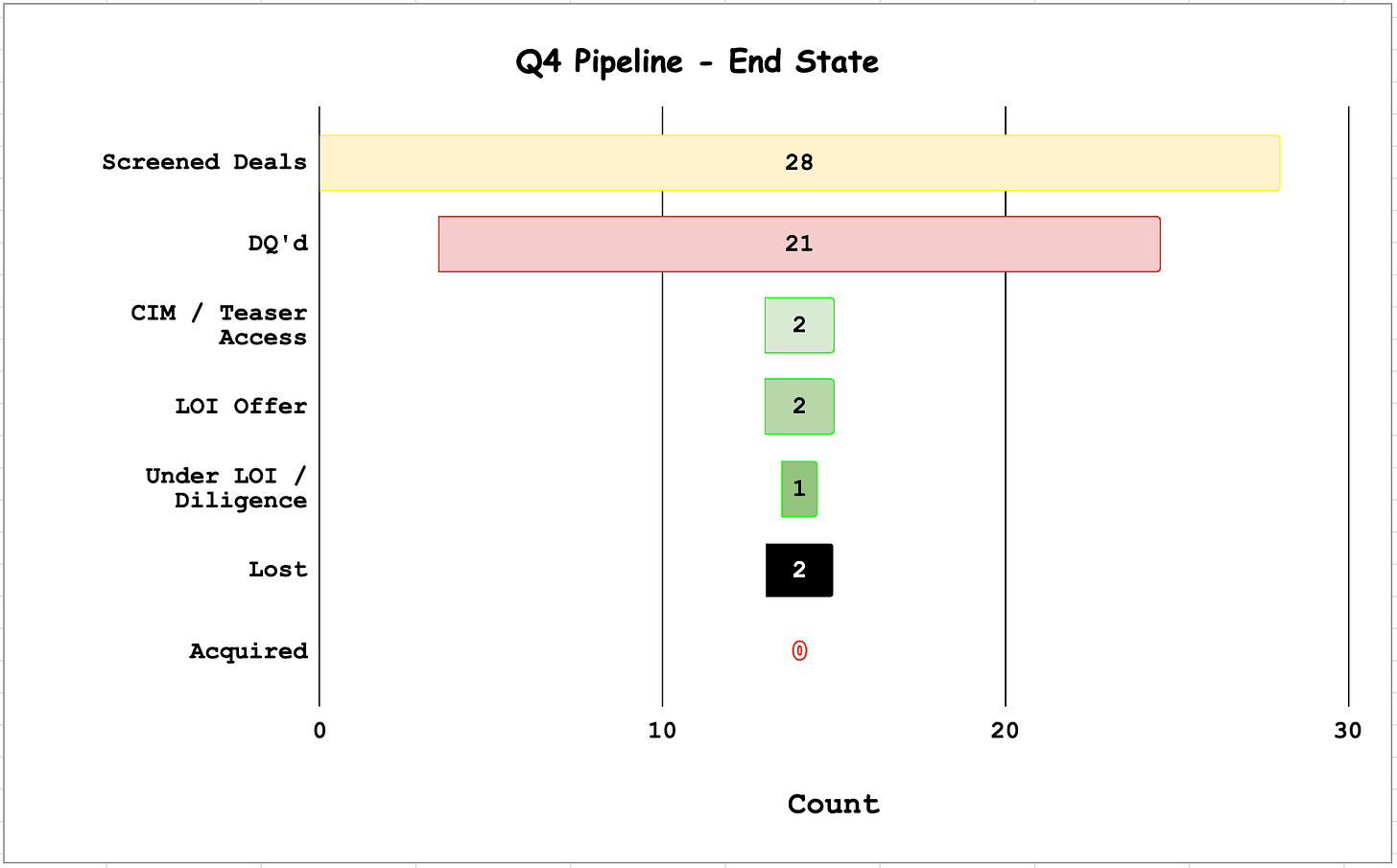

Now, onto what we can consider pipeline analysis 101, but first some definitions:

Stage Definitions:

Screened Deals: passed our initial quantitative screening criteria

Disqualified: failed qualitative screening based on public info (or post-NDA info; we intend to delineate between the two moving forward)

CIM / Teaser Access: (self explanatory)

LOI Offer: we provided an LOI, signaling value and terms

Under LOI / Diligence: the LOI was accepted and we dive deep into a range of items, providing qualitative inputs and a quantitative score, which culminated in a weighted deal score

Lost: regrettable outcome (e.g. beat to the punch on an LOI)

Acquired: what we’re here to do!

Comments:

Volume: We’re generally satisfied with the top-of-funnel, 28 deals is a net new deal every ~3days

Conversions: 75% of deals were DQ’d (more on that below). There is of course a fine line / tradeoff at play, where you want to be picky and not compromise the integrity of your screening criteria, though not to the extent it straight chokes deal flow. All things considered, we’re pleased with 1 out of every 4 deals passing our preliminary filters

Primary loss reasons:

Beat to LOI (very frustrating, though LOTS of deals come back around)

Couldn’t provide asset-level tax returns, which is a deal breaker for most debt financing providers

DQ patterns:

Horizontal (applying some NLP, where we look for keywords in the listing, should help avoid this deals making it through our initial filter in the future)

Requires sales-led-growth (aka hiring a sales team, which swells customer acquisition costs and breaks the unit economics and operating model we’re after)

Lack of validation in segments required for growth. As an example, a SaaS has very strong traction selling direct to employees (users), though growth requires selling to the employer (accounts) and we can’t point toward undeniable proof of traction in these segments

⚙️ OPERATE

Resource: LINK TO NOTION TEMPLATE

APPLICATIONS:

A turnkey template for building a transformation roadmap, organized by stage (Seller Transition > Fix > Improve > Grow) and domain (Customer Success, Product, and so on). Please note: the example activities skew toward the seller transition, fix and improve stages given our current focus. Also, there is a field for dependencies, where you can link activities together and ensure appropriate sequencing. “Most plans are correct, they just lack a sense of priority and thoughtful sequencing.”

🤔 MUSINGS

Paradox: ‘Discipline = freedom’ vs ‘bend don’t break’

Jocko Willink, a renowned leadership sage and former Navy SEAL, made this adage commonplace. I subscribe wholeheartedly to the notion that we move through most activities in a mindless state (aka muscle memory - when’s the last time you consciously brushed your teeth?), though we can use this to our advantage by installing habits. Ideally, we execute our habits without much thinking.

The routine is ‘hardwired,’ the ‘software is installed'.

On the other side of the equation is the notion that we mustn’t blindly adhere to a routine or set of activities such that we forget to be nimble or gentle with ourselves. Most importantly, we must always keep space for an open mind, one that embraces iteration over time.

Should we get knocked off our rhythms or find ourselves in an environment that makes our typical routines difficult, we can bend without breaking and likely still get close to the desired outcome. For instance, we find ourselves without access to a gym. How can you improvise to get a sweat in?