🏴☠️ ⚡️ Issue #9: CRM for Spanish SMBs & 'Jobs to be Done'

Welcome! This newsletter is dedicated to acquiring and operating Micro SaaS firms. Join us every other Saturday morning for deal analysis, operating frameworks / templates, and other musings...

The deal discussed in this issue focuses on an acute decision point for Skaling Ventures - when do we start targeting international Micro SaaS firms? My hope is the teardown brings some of the tradeoffs involved to light with an exciting and real opportunity.

With our operator hat on, we dive into a workshop guide based on 'the ‘Jobs to be Done’ framework, which is one of the highest leverage activities I’ve come across for quickly generating value proposition statements that can be used across the business.

🎯 ACQUIRE — CRM for Spanish SMBs doing $850k ARR with 42% profit margins

⚙️ OPERATE — Guide for a workshop based on Jobs to be Done (JTBD)

🤔 MUSINGS — 2x questions to uncover operating leverage and business impact

🎯 ACQUIRE

// DEAL TEAR DOWN

FIRM PROFILE (Public Listing)

“Profitable SaaS with $850,000 in TTM revenue and $360,000 in TTM profit for small and medium-sized B2B businesses in Latin America and Spain. It helps companies automate their sales follow-up process”

ASKING PRICE: $4.25M

TTM REVENUE: $850k

FOUNDED: 2019

REVENUE MULTIPLE: 5x

TTM PROFIT: $360k

TEAM SIZE: 4 FTEs

PRODUCT STACK: PHP

GROWTH: Unknown

SV SCORECARD AVERAGE

💥 2.3 / 4

STRENGTHS

REGIONAL GROWTH POTENTIAL - According to a report by MarketsandMarkets, the global CRM market size is expected to grow from $43.7B in 2020 to USD $96.5B by 2025, at a CAGR of 17.6% during the forecast period. While the overall market growth for CRM in Latin America is expected to be robust, the penetration of CRM among SMBs is relatively low compared to other regions.

North America and Europe are the regions with the highest CRM penetration for SMBs, followed by the Asia-Pacific region. In contrast, Latin America and the Middle East and Africa (MEA) have relatively lower CRM penetration rates for SMBs.

CULTURAL / LANGUAGE SPECIFIC - The three rules of commercial real estate are ‘location, location, location’. In Micro SaaS, and perhaps marketing in general, this translates to ‘audience, audience, audience'. Accommodating cultural context and language fits right in line with the principle of being hyper fixated on a persona or an ideal customer profile (ICP) when building and iterating on a product. Regional growth potential + built specifically for the region = 🧨.

RISK FACTORS

COUNTRY / MACRO RISK - Where a Micro SaaS operates / is domiciled has definite implications when it comes to actually executing the acquisition. However, from a business perspective, we are mainly concerned with where a business’ revenues come from. Are there factors that might disrupt the broader business environment / your users to then choke your revenues?

If we use Brazil as an example, here are some of the macro and country risks to be aware of:

Currency and Exchange Rate Risks: The Brazilian economy is highly dependent on commodity prices, which can lead to fluctuations in the value of the Brazilian real (BRL). These fluctuations can affect the profitability of the SaaS firm, especially if it generates revenue in BRL and has expenses in other currencies. The exchange rate risk can be hedged, but this adds a layer of complexity.

Political Risks: Brazil has a history of political instability, corruption, and economic crises. Changes in government policies and economic conditions can affect the SaaS firm's operations, such as changes in tax rates, labor laws, or government contracts.

Regulatory Compliance Risks: Brazil has complex and constantly changing regulations regarding taxation, labor, and data protection. A SaaS firm that serves customers in Brazil must comply with these regulations to avoid legal and financial penalties. Failure to comply with these regulations can lead to legal and financial penalties, damage to reputation, and loss of customers.

CROWDED CATEGORY / MASSIVE PLAYERS - Customer Relationship Management (CRM) has long been considered a core pillar of enterprise technology (together with accounting / ERP and HR tech / HCM) . SalesForce and Hubspot are household names and there are a massive range of long tail competitors (Zoho, Pipedrive, etc.). The good news is that the market is educated and the core concepts of a CRM are understood. This is also something every business under the sun needs (aka horizontal). The bad news is differentiation must make up for inferior economies of scale and brand awareness, which is very difficult to a) achieve and b) communicate to the market.

QUICK WINS & OPPORTUNITIES

VERTICALLY-SEQUENCED GTM - If you ‘market to everyone, you market to no one,’ which is a common pitfall in horizontal Micro SaaS. On the other side of the coin, vertical SaaS typically doesn’t provide the Total Addressable Market (TAM) to support billion+ dollar outcomes. An interesting goldilocks strategy is to take a horizontal SaaS and target / acquire 1x very specific niche / vertical at a time. Upon penetrating the first vertical, you modify the GTM machine and point it at the next most compelling vertical, and on and on you go.

USER-LED ONBOARDING - I’d bet this SaaS has a ‘click here to talk to sales / get a demo,’ as user-led onboarding / PLG is notoriously difficult to execute in the world of CRM (think: import all your customers, set up pipelines, modify reports and automations, etc.). With that said, it has been done by firms like Hubspot, yielding playbooks and thought leaders to study. In addition, there is an entire universe of tooling available, given the state of the SaaS art. If you were able to build conviction on executing this transformation, the velocity of sales cycles would reduce significantly (think: sales people / demos vs ‘buy now’) and those rapid growth is easier to achieve.

MARKET COMPS

Micro SaaS with ARR: $800k to $900k

~Asking Price: $6.6M — ⬇️

~Revenue Multiple: 8.2x — ⬇️⬇️

~TTM Profit Margin: 47.5% — ↔️

~Growth Rate: 40% — ❓🤷♂️

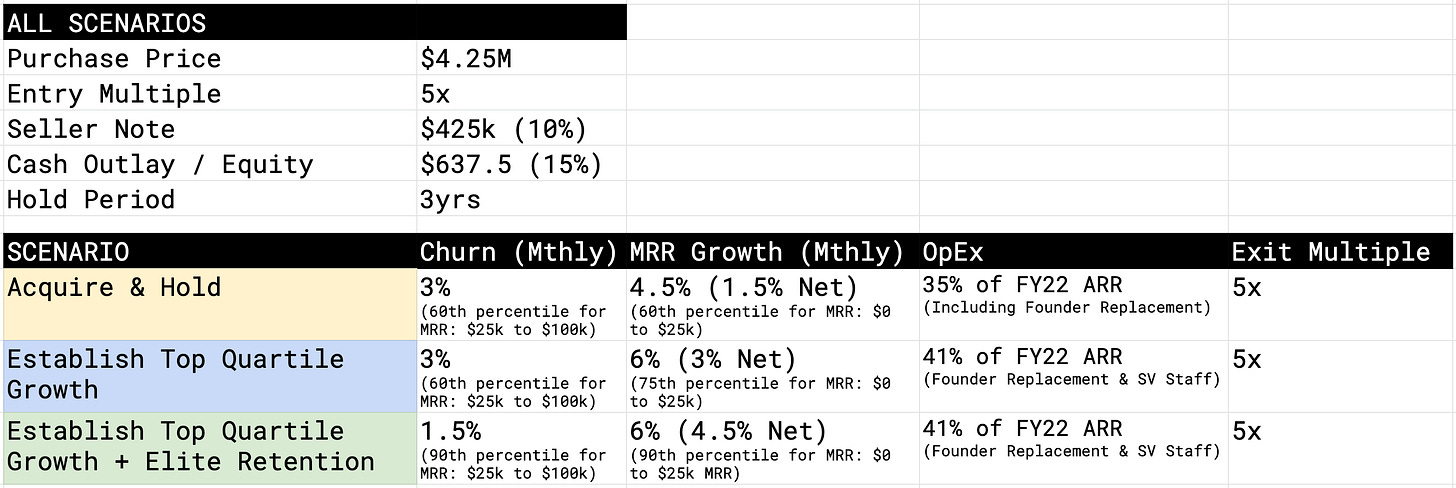

RETURN SCENARIOS

ASSUMPTIONS -

RETURNS -

⚙️ OPERATE

RESOURCE - Workshop Guide: Jobs to be Done (JTBD)

APPLICATION(S) -

A framework to quickly generate and upvote value propositions from your team, which can then be applied just about everywhere, from product management and sales messaging, to customer success and beyond.

🧐 Musings

“So what?”

“Why now?”

I’ve observed that the more the above questions are asked, the better the business outcomes get. ‘So what?’ forces you to think about the second and third order impact a given activity can provide. And ‘why now?’ puts it into the greater context of the business at that point in time.

As an example:

I want to analyze the patterns in our customer support tickets — so what?

So I can determine which module(s) the support tickets are concentrated around — so what?

So I can refresh the associated support content and prevent these tickets from happening, and thus lower the cost to serve customers — why now?

We, like everyone, are prioritizing profitability and we’ve attacked every other area of the business so those functions represent diminishing returns for cost savings — RADICAL! Go baby go 🚀

Without introducing the constructive tension above, it’s easy to run at any given activity or priority. Time does not scale; thus, it is the true finite resource that fuels a business. Given the constraint of time, priority must be a function of operating leverage / business impact. Simply put: let’s find the things that give us multiple units of return, in exchange for a single unit of energy. These simple questions force you to contemplate true business value. If they aren’t asked in every meeting, there is cause for concern the team is wasting cycles.

Thanks for the read.

I'm currently working on sell-side mandate in Brazilian ERP (around $2.5M ARR) for micro/SMB retail space

My few thoughts:

1. LatAm is obviously a pure emerging market risks&returns play. "Risks" pf Political&Regulatory&Currency&Macro issues very often give you "return" of double-digit market growth, digitally untapped verticals, lower multiples etc.

2. Currency risk in Brazil isn't such a drama, especially compared to other EMs. There was a 40% depreciation in the beginning of COVID, otherwise last 4 years has been pretty stable at even more appreciation periods. Not a guarantee of course if other macro could come into play to adverse things, but still pretty much favourable compared to other EM peers.

3. TAM - agree on market opps. Brazil is a highly entrepreneurial country with around 1M net new micro/SMBs setup each year, depending on the economy cycle.

4. Valuations - while multiples are of course being exposed to country risk, strong assets aren't being too discounted to developed countries comparables (meaning Western Europe in this ex.). I'm currently talking LOI at 7-9x EBITDA with several European and local buyers. Again, I mean strong quality assets, like double digit ARR grow, 30%+ EBITDA margin etc.