🏴☠️ ⚡️ The Hidden Systems Behind ARR (and Why Most SaaS Founders/Operators Misread Growth)

Join us every Saturday morning for value creation playbooks, operating concepts, deal analysis and diligence frameworks, and more...

TABLE OF CONTENTS:

Why Most Operators Misread Revenue

Root Issues in Our Context (Bootstrapped Firms)

Why Rebuilding the ARR Waterfall Unlocks Value Creation

How to Build (or Fix) Yours (The Realist’s Version)

Final Thoughts: ARR Is a Mirror, Not a Metric

📺 WATCH:

📻 LISTEN:

"Revenue looks flat. The P&L isn’t moving. But sales is closing, onboarding is busy, and customers are expanding."

If you’ve ever stepped into a founder-led SaaS business—or operated one yourself—you’ve likely felt this mismatch.

It’s not a product problem. It’s not a sales problem.

It’s a system blind spot.

Because ARR isn’t just a finance metric. It’s the output of four interconnected systems:

Marketing → Sales → Onboarding → Finance

If one system breaks down, your growth engine quietly stalls—and basic reporting won’t tell you where or why.

That’s why your first move isn’t a new sales comp plan or GTM playbook. It’s rebuilding the ARR waterfall—so you can see what’s really happening, and where performance is leaking.

Why Most Operators Misread Revenue

ARR is the de-facto metric in our world, but few appreciate the mechanics and interpret as lagging indicator produced by a series of chained-together systems:

Marketing: turns leads into opportunities

Sales: turns opportunities into bookings

Onboarding: turns bookings into billable accounts

Finance: turns billables into recognized revenue

When any of these break—unqualified leads, incomplete contracts, activation delays—ARR suffers. But unless you’ve built a system to surface that friction, you’ll never know why.

The ARR waterfall is a diagnostic tool for revenue system performance.

It’s not about tracking revenue after the fact. It’s about exposing where your systems need to improve.

Root Issues in Our Context (Bootstrapped Firms)

Most founder-led SaaS companies are built for speed, not instrumentation. They prioritize product, customer value, and survival. But that often comes at the expense of reliable data and system-level visibility.

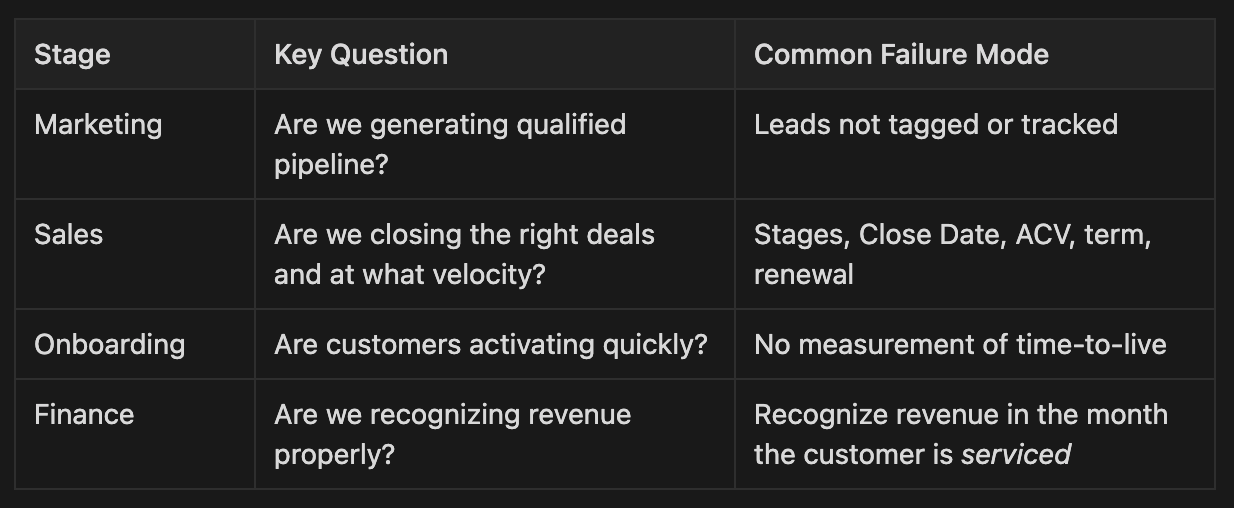

Here’s how that misalignment shows up across the four systems that produce ARR:

Marketing

No consistent lead qualification or attribution process

Pipeline sourcing is unclear (inbound? outbound? referral?)

No feedback loop from Sales on what converts

📉 Result: Unclear lead quality, and hard to predict future pipeline yield

Sales

No established CRM—or if one exists, it lacks data hygiene and rigor

Inconsistent deal stages, unreliable close dates, no contract structure

No required fields for ACV, term, billing frequency, or renewal type

📉 Result: Impossible to measure win rates, average deal size, or sales velocity

Onboarding

Handoff from Sales is inconsistent or informal

Time-to-live is not measured or benchmarked

No structured onboarding stages or success milestones

📉 Result: Customers go live late, adoption is uneven, and time-to-value is invisible

Finance

No distinction between bookings, billings, and revenue

Annual prepay recognized all at once as "revenue"

No deferred revenue ledger or contract tracking

📉 Result: P&L looks inflated or momentum is hidden in bookings, and forecasts are built on cash—not GAAP (aka real world) accounting

This is why rebuilding the ARR waterfall matters: it helps you connect the systems that drive revenue and expose where they’re breaking down.

Let’s name the full revenue realization chain:

Marketing → Sales → Onboarding → Finance → P&L

Your P&L is a snapshot. The ARR waterfall reveals where your systems are building or leaking momentum.

Why Rebuilding the ARR Waterfall Unlocks Value Creation

Rebuilding your ARR waterfall isn’t about finding hidden growth. It’s about:

Pinpointing friction in your revenue engine

Aligning teams around actual performance (not opinions)

Recasting targets based on reality

What you unlock:

Visibility into new vs. expansion momentum

Forecasts tied to actual sales velocity and time-to-live

Clarity around deferred (aka unearned) vs. recognized revenue

Foundation for quota design, capacity planning, and board reporting

The ARR waterfall isn’t a spreadsheet. It’s a system health check.

How to Build (or Fix) Yours (The Realist’s Version)

You don’t fix an ARR waterfall by brute-forcing a spreadsheet.

You fix it by running the business on clean inputs for a sustained period—long enough to generate a clear, trustworthy picture of how revenue actually behaves.

Step 1: Define What “Clean” Means for Each System

Start with minimum viable instrumentation across the 4 core systems:

🔹 Marketing

Track lead source + channel in a consistent field

Define what qualifies as an opportunity (MQL/SQL criteria)

Establish a feedback loop from Sales on lead quality

🔹 Sales

Standardize pipeline stages with clear entry/exit criteria

Require ACV, billing term, contract length, renewal type

Maintain accurate close dates and sales cycle start date

🔹 Onboarding

Define time-to-live: the moment a customer is fully active

Track key onboarding milestones (technical setup, first value)

Record when revenue can be “billed” (aka earned and recognized) not just signed (aka booked)

🔹 Finance

Separate bookings (signed contracts), billings (invoices), and revenue (recognized)

Track deferred revenue (unearned income) and prepaid cash

Align contract metadata between CRM and ERP

💡 Don’t build dashboards until these fields are reliably populated. Otherwise, you’re charting fiction.

Step 2: Run on Clean Data for 1–2 Sales Cycles

Once fields are defined and instrumentation is in place, run the business normally for at least 60–90 days.

This gives you real velocity, expansion, churn, and onboarding patterns to work with.

Don’t jump to conclusions based on legacy data

Avoid rebuilding the waterfall off assumptions or partial records

Focus on operating discipline first, analysis second

Step 3: Build the ARR Waterfall from Operational Reality

With trustworthy data from every system, now construct the waterfall:

Beginning ARR (from prior period)

+ New Business ARR

+ Expansion ARR

– Churned ARR

= Ending ARR

Optionally, layer in:

Contracted vs. Run-rate ARR

Sales velocity by segment

Time-to-live by product or persona

NRR, GRR, and logo retention views

Step 4: Use the Waterfall to Tune the System

Don’t just look at the numbers—look at what’s causing the movement.

Churn spiking after 90 days? Onboarding issue or poor ideal customer fit (sales and marketing).

Expansion dragging? Weak product activation.

New ARR inconsistent? Pipeline or close rate problem.

Cash vs. revenue mismatch? Broken finance mapping.

The waterfall isn’t a scoreboard—it’s a diagnostic tool. Once built, it helps you tune every part of your go-to-market machine.

Final Thoughts: ARR Is a Mirror, Not a Metric

The ARR waterfall doesn’t just track revenue. It reflects how well your systems are working.

If your waterfall is jagged, stalling, or inconsistent—that’s not a reporting issue.

That’s a system design problem.

Rebuilding the waterfall doesn’t just reveal growth. It exposes friction. And friction is where value creation lives.

Hit REPLY and let me know what you found most useful this week (or rock the one-question survey below) — truly eager to hear from you…

And please forward this email to whoever might benefit (or use the link below) 🏴☠️ ⚡️