Welcome back! Scroll away, or use the links below to jump to it:

Hope it’s been an OUTSTANDING WEEK.

(Feedback always welcomed and sincerely appreciated 🙏)

🎯 Deal Tear Down

// FIRM PROFILE (PUBLIC LISTING)

Software to help animal breeders track production, pedigrees, analytics, finances, and more

“Profitable SaaS with $197,566 in TTM revenue and $143,036 in TTM profit (SDE) offering an all-in-one Rabbit Farm Management Software. Our cloud-based web software and native mobile apps for iOS and Android give you constant access to all your rabbit records from any device.”

Asking Price: $786k

TTM Revenue: $226k

Founded: 2017

Revenue Multiple: 4x

TTM Profit: $143k

Team Size: 6

Product Stack: PHP (Laravel), MySQL, React

Growth: 34% YoY

// SV SCORECARD AVERAGE

💥 3.14 / 4

// STRENGTHS

Cash to Service Debt and Fuel Growth — The 6 person headcount is strangely high, given the revenue and net income figures so we have to assume fractional / part-time contributors focused mainly on engineering (vs fully loaded FTEs). The founder is likely taking some cash out of the business as well, providing a chance net margin could flex up into the ~80% range.

Product Led / Non-linear Growth — It seems most traction is with SMB (1 to 10 employee breeders), though they do hihglight one enterprise client. Sales led growth (SLG), typically a requirement for enterprise customer acquisition, is not part of the SV model / value creation plan. This said, it’s an interesting option to keep on the table, where you can layer traditional sales-led tactics onto a foundation of PLG (a16z: Growth+Sales) for select, high value up market accounts. Moving upmarket is typically opting in to the following tradeoff: longer sales cycles and chunky / harder to forecast revenue in exchange for larger contract values and longer lifetime values (or better retention, as big ships are harder to turn).

Sticky as hell — similar to last issue, we again see a spin on a ‘business management platform’ that is highly catered to a niche where the venture backed players going after every SMB under the sun have a hard time competing at the nuanced feature level. Additionally, this SaaS pulls workflows and data together across the holy trinity (customers/CRM + books/ERP + team/HCM), which is not easy for a customer to move away from. The dark take on this from OG SaaS providers was ‘to provide a level of utility / service that is just above the pain of switching…’.

// RISK FACTORS

Financial Sponsor pursuing a rollup — following a quick and dirty industry landscape audit, it seems the market is mostly oriented around dog breeders / kennel operators and horse breeders / stable operators, though there are obviously a wide range of other breeders who compete on pedigree, etc., which requires documentation and rigorous process. There seems to be a pretty obvious chance to raise some proper capital, acquire the most compelling player (regardless of the exact niche) and consolidate the top ~3 to accomodate he lions share of the animal breeder use cases and away you go. It would be a bummer to make a move on this deal, only to find a better capitalized player is in the process of executing the above (and you don’t fit into their plans…).

// QUICK WINS & OPPORTUNITIES

Alternative data sets — similar to last issue, only there is much more public record at play in this category (think: American Kennel Club) providing an opportunity to short list the major players in most niches, in addition to gaining a sense of decision making, as executives, etc. are often listed as accountable parties when registering with a regulatory body or something similar.

ICP expansion — this is an obvious one (dogs > horses > rabbits > llamas), perhaps in a future issue I’ll comment further on the order of operations re sequencing markets. In the meantime, here is some legendary input from Thiel on the topic: Three Steps to Building a Monopoly

// MARKET COMPS

ARR: $150k to $350k

Asking Price: $1.11M

Revenue Multiple: 5.27x

TTM Profit Margin: 61%

Growth Rate: 80%

Prelim re Asking Price:

Relative to the above, the deal at hand has above average margin and growth is very healthy at +30% YoY. All things considered with the info available, 4x seems reasonable for this deal, though we need to lean into the usual suspects (net retention, founder replacement costs that would erode EBITDA, etc.)

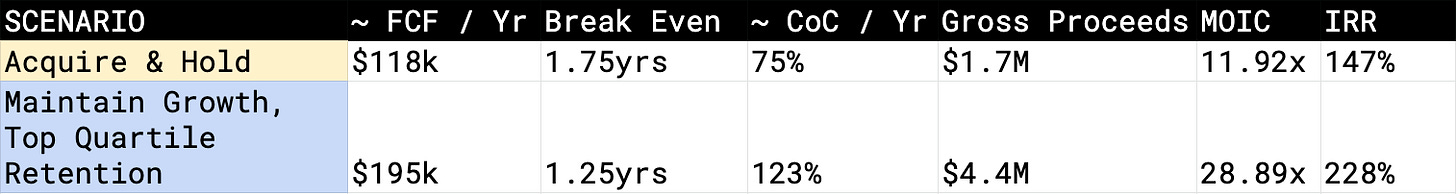

// RETURN SCENARIOS

Assumptions —

All:

Entry Multiple: 4x

Cash Outlay / Equity (20%): $130k

Hold: 3yrs

Acquire & Hold:

Median Mthly Churn Rate ($0-$25k MRR): 4.5%

Mthly Growth: 7.33% (2.8% Net…34% YoY)

Status Quo Costs (% of ARR): 35% (assuming founder replacement costs)

Exit Multiple: 4x

Maintain growth, top quartile retention:

Top Quartile Mthly Churn Rate ($0-$25k MRR): 2%

Mthly Growth: 7.33%

Status Quo Costs + SV Team (% of ARR): 39%

Y1 Transformation Costs (% of ARR): ~4%

Exit Multiple: 5x

Move up market and layer in Sales-led-growth:

**Don’t have a template model built for this, but generally you’d need the following base rates / assumptions to layer in revenue from this model of acquisition:

Qualified Opportunities (total # in pipeline at any given point in time)

Win Rate (the % of the above you win)

Average Contract Value (the average $ per win)

Cycle Time (# of days to win)

🤖 SaaS Playbook

RESOURCE: Growth Loops are the New Funnels

APPLICATION: “Once you start viewing things through loops, you stop approaching acquisition, product, and monetization in silos. It forces you to think about how the three work together in a system. You stop thinking about the never ending cycles of more tactics, more channels, more of everything just to keep filling the top of the funnel, and you start thinking about how what you are producing can be reinvested.”

🧐 Musings

“Action removes doubt.”

In theory, a comfort zone should be this ever expanding thing, as you boldly press on and come to conquer what was previously foreign or uncomfortable.

It was once said to me, and I came to pass it along to colleagues and team members, that the best performers consistently operate in a mix of conditions like the following:

60% is familiar, high confidence

25% is new and challenging

The remaining 15% is straight terrifying abyss

This said, it’s our responsibility to seek out environments that provide this mix and move on when the time comes. As I enter a new setting and perhaps the mix is indexed a little / lot heavier to the new and challenging (or abyss), I’m always reminded that ‘action removes doubt.’

Stay moving. Before you know it, the ratio is right where you want it. Then sometime after, which is likely sooner than you appreciate, the task is to move on to new territory entirely.

great detail and analysis of that SaaS biz.. im running an MVP of a SaaS in therapist practice space.. and has given me some good ideas