🏴☠️ ⚡️ Issue #20 - Multiple Arbitrage in Micro SaaS (Musings)

This newsletter is dedicated to Acquiring and Operating Micro SaaS firms. Join us every Saturday morning for acquisition case studies, operational tactics, growth frameworks, and more!

TABLE OF CONTENTS:

Part 1 — 🎯 DEAL TEARDOWN - Seafood Supply Chain SaaS Doing $750k ARR

Part 2 — ⚙️ OPERATING CONCEPT - Buyer / Acquirer Profiles in Micro SaaS

Part 3 — 🛠️ OKR TEARDOWN - Product / Feature Release Playbook

Part 4 — 🤔 MUSINGS - Multiple Arbitrage in Micro SaaS at $1M ARR…?

🙏 HELP US CALIBRATE OUR CONTENT VIA THE SURVEY BELOW 👇

🤔 MUSINGS

📺 WATCH:

📻 LISTEN:

MULTIPLE ARBITRAGE IN MICRO SAAS

A CONVENTIONAL PLAYBOOK IN LOWER MIDDLE MARKET PRIVATE EQUITY

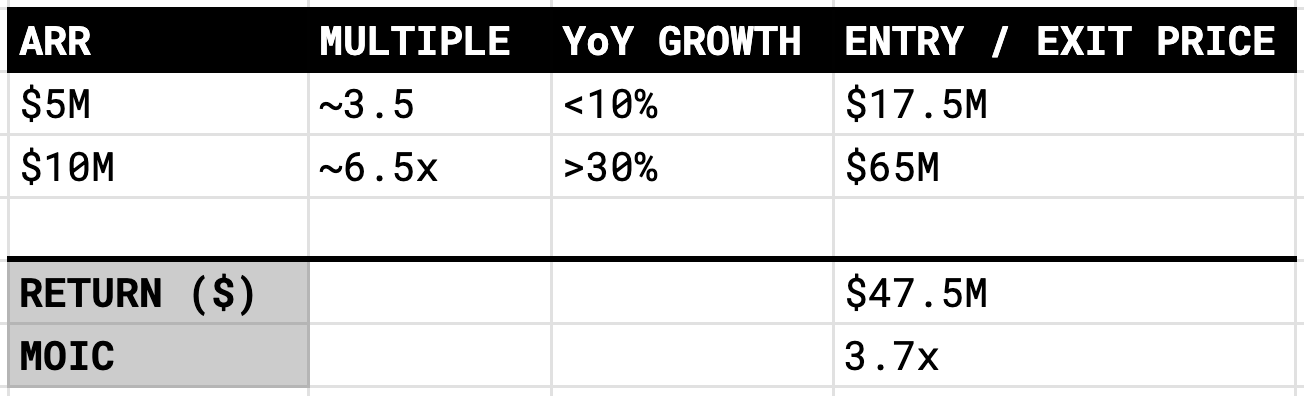

Historically, lower middle market SaaS buyout strategies are built around a playbook that involves acquiring a sub-scale SaaS business at ~$5M for ~3.5x and growing it to $10M to then exit at a ~5x-8x. This playbook exploits ‘multiple arbitrage’ where the market perceives larger firms as more stable, thus they command a premium and multiples naturally expand (to a degree) as a function of ARR category ($5M vs $10M). From a growth perspective, the holy grail is to 2x the firm in 3yrs or less (at a ~30% CAGR).

The exponential effective of multiple expansion applied to a now larger ARR category (aka base) is truly one of the greatest wealth / value creation recipes known to humankind. Here’s a very simple example (assuming all cash deals, though this changes a lot with debt) to convey the point:

It’s important to note that ARR category is only one component of the multiple recipe, which makes it hard to isolate the impact among other components like growth and profitability, etc. (note: the value of these dimensions also varies by investor).

THE TENDENCY FOR MICRO SAAS STRATEGIES TO RELY LESS ON MULTIPLE ARBITRAGE

We assume the average Micro SaaS firm is boot strapped and the Founder’s core competency is product / engineering. Thus, we seek to acquire these firms and apply our go-to-market (GTM) competency to establish 1x+ productive distribution / acquisition channel. Simply put, grow the business organically.

At the same time, Micro SaaS firms typically cater to niches, where the competition is fragmented, which sets up well for a roll up strategy. Here, you acquire / consolidate Micro SaaS firms in the same niche to create inorganic growth.

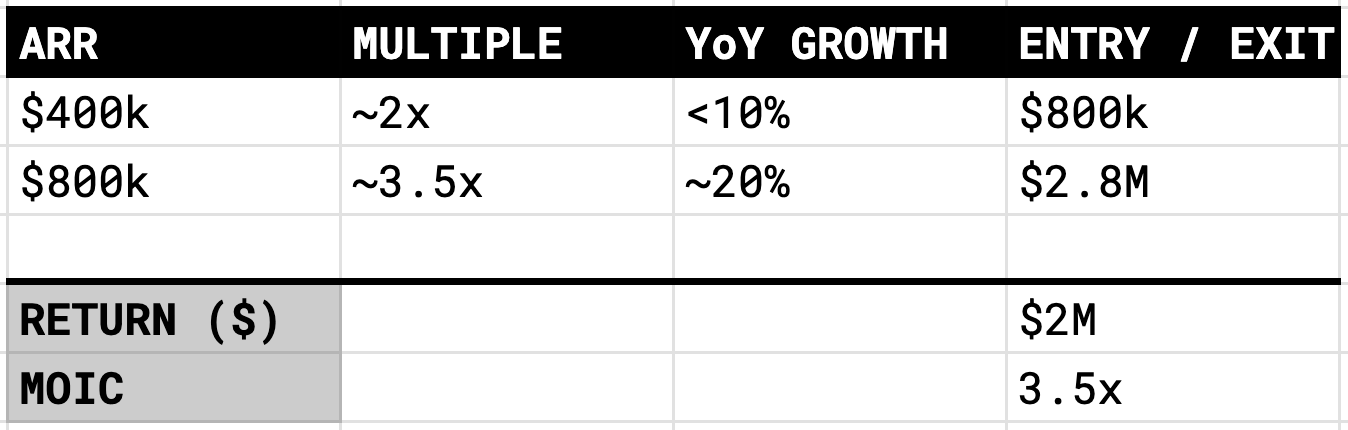

Either way, the root value creation lever is top-line growth. Most times, there’s also an opportunity to create margin expansion by implementing an ‘atomic operating unit’ (aka the minimum viable operating team), but more on that in another post. It’s widely held that Micro SaaS firms (aka <$1M ARR) trade at a ~3x, unless there is explosive growth, though this is rare and these firms almost always pursue the venture track. As such, we seek to acquire deals at <3x multiples to then achieve a median multiple, as a function of top quartile growth and enduring profitability. All to say, we rely less on multiple arbitrate and simply try to grow the base (aka ARR) to which the multiple applies. Here’s an example (though again, note: debt changes this drastically):

This strategy gets interesting when you consider our ‘atomic unit’ operating model, which theoretically provides outsized operating leverage (aka MRR or Net Income per contributor or employee). Simply put, you can move faster and do a greater volume of deals as a function of repeatable systems (vs bulls*** playbooks) and the atomic unit, which can scale scale across a few firms without adding human / management load. The cumulative effect of a high volume of deals, in a less competitive segment (aka lower valuations), with lighter management load yields returns that outperform conventional lower middle market buyout strategies, as measured by MOIC and IRR (our time horizons are MUCH shorter).

As you’ve probably noted by now, we’re thinking a lot about fixating on rollups as a core component of our thesis moving forward…

To build conviction, we need to answer one simple question: in our segment, is there evidence of natural multiple expansion (or multiple arbitrage) and the same dynamics found in typical lower middle market PE…?

A CLOSER LOOK AT MULTIPLE BENCHMARKS IN PRIVATES

As a point of departure, let’s first look at private market benchmarks, where data is notoriously opaque, though more readily available than it is in Micro SaaS. Put simply, no one discloses details like valuations in private market transactions. Thus the benchmarks we reference below should be taken with a grain of salt, as all are a function of public market comps and private firm surveys, etc.

With that disclaimer out of the way, I’d suggest decent conviction around $1M as a hallmark hurdle for unlocking 5x+ multiples.

(Source)

Though as noted, ARR category is only one dimension of valuation, which is not included in the table above. If we include growth, our conclusions change.

(Source)

Here we see a structural decline in multiples as ARR category grows, though growth rates also decline with larger ARR categories (which makes sense, given every unit of growth becomes increasingly difficult as you penetrate the market). In light of this, there is reason to believe the ‘rule of 40’ reigns supreme, where healthy, profitable growth is the most attractive characteristic for the common investor. ESPECIALLY IN THIS MARKET.

All to say, achieving an ARR category likely doesn’t unlock multiple expansion by itself. Furthermore, I believe investors today think a LOT LESS about ARR category, and thus, are less inclined to assign a notable premium based on scale alone, or otherwise.

A CLOSER LOOK AT MULTIPLE BENCHMARKS IN MICRO SAAS

(Source)

Now changing gears to Micro SaaS.

As noted prior, 3x is a common expectation in our segment. We also see multiples decline as ARR category increases, where it’s likely that YoY growth rates also decline as ARR category grows. It’s also worth noting that $1M+ deals are very thinly represented in the benchmarks so we need to tread lightly when drawing conclusions from this data.

If we synthesize all findings, I don’t believe ARR category is in the top three attributes that inform a multiple. Said another way, ARR category is not more important than growth, profitability or gross retention.

Lastly, the world of multiples and valuations are in the midst of a hardcore correction, where unsustainable ‘growth at all costs’ is punished. Capital efficient growth is the name of game…Duh.

BRINGING THINGS BACK TO MICRO SAAS STRATEGIES MOTIVATED BY ACHIEVING HIGHER ARR CATEGORIES TO EXPLOIT MULTIPLE EXPANSION

ARR category unto itself does not appear to create multiple expansion in Micro SaaS, or any other market segment. It follows that achieving an ARR category is more of an afterthought than a north star or mission critical achievement.

I’d like to suggest that achieving $1M in ARR and rule of 40 is the most productive way to generate multiple expansion in Micro SaaS. There are no other obvious ARR category trenches (ie $500k or $750k ARR) where multiples expand on average, and growth / profitability is always part of the picture.

Admittedly some of the thought process here isn’t fully baked and I have mediocre conviction in the data that substantiates my point of view, but it’s a start…

Regardless, I’m comfortable moving forward based on the above ‘directional’ conclusions. It seems now, the most important questions are:

What is our confidence level re generating compelling growth and/or profitability via a roll up that places us in the $1M+ ARR category?

Is it easier to generate breakout growth / significant profitability in a single entity (at say, $500k ARR), which would yield similar multiple expansion?

I’ll leave it at that for now.

For the love of the game 🏴☠️ ⚡️

Continued Reading: